For millennials looking to purchase a home, especially younger ones, the Federal Housing Administration program has become a go-to product, according to Ellie Mae.

"FHA loans were especially popular among younger millennials under age 30," said Joe Tyrrell, president of ICE Mortgage Technology, Ellie Mae's parent company. "Nearly a quarter of them chose this financing option, in part because of the more flexible qualification criteria; however, older millennials preferred conventional loan products."

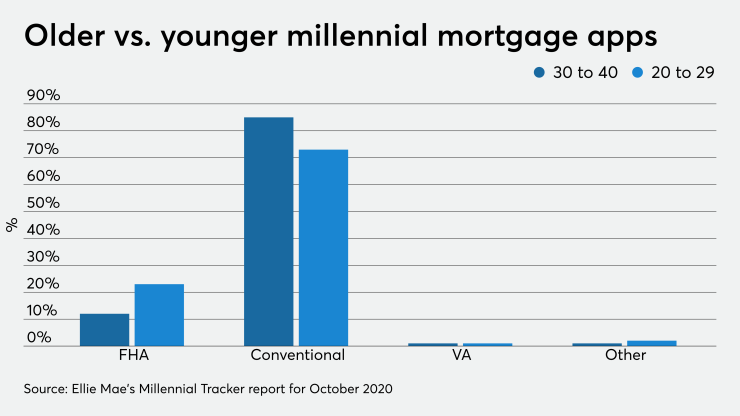

Ellie Mae breaks out this generation into two groups: those between ages 21 and 29 and those between 30 and 40.

In October, 16% of millennial borrowers opted for an FHA loan, with 93% of those being used for a purchase. Those under 30 years old sought an FHA product 23% of the time, while 30 or older applied for one 12% of the time.

For all millennial mortgage borrowers, 56% took out a new loan in October for a purchase and 43% for a refinance, with the data for 1% not specifying the purpose.

Meanwhile, older millennials sought conventional financing 85% of the time versus 73% for younger ones. Veterans Affairs-guaranteed loans had a miniscule 1% share for both groups.

Still, FHA loans are more popular among millennials than the market as a whole. The Mortgage Bankers Association's application survey for the week of Nov. 27 gave the FHA product

As a group, younger millennials had a lower average FICO score than their older counterparts in October, 729 versus 748 and that, too, supports being more receptive to FHA financing.

The report found that the average turnaround time for a loan did not change from September to October, at 49 days.