The Federal Housing Administration has updated its new schedule of loan limits for 2018, with most areas in the country set to experience an increase.

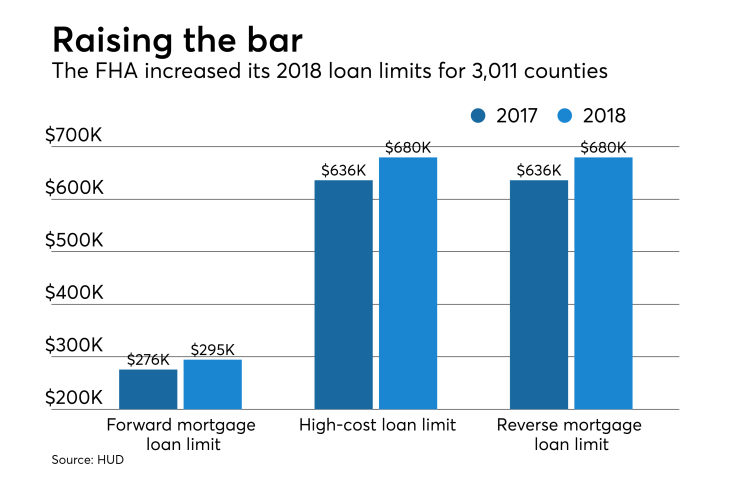

The national loan limit for one-unit homes will be $294,515 in 2018, up from $275,655 this year. In high-cost areas, county-level loan limits can be as high as $679,650, up from $636,150.

The maximum loan limits for FHA forward mortgages will rise in 3,011 counties and apply to FHA case numbers assigned on or after Jan. 1, 2018. In 223 counties, FHA's loan limits will remain unchanged.

The limit for FHA-insured Home Equity Conversion Mortgages will rise to $679,650, from $636,150. While forward mortgage loan limits are set on the county level, there is only a single loan limit for all reverse mortgages.

The National Housing Act, as amended by the Housing and Economic Recovery Act of 2008, requires the FHA to base its floor and ceiling limits on the loan limit set by the Federal Housing Finance Agency, which will

The FHA's minimum national loan limit is set at 65% of $453,100, which applies to areas where 115% of the median home price is less than the floor limit. Areas where the loan limit exceeds this floor are considered high-cost, and HERA requires the FHA to establish its maximum loan limit ceiling for these areas at 150% of the national conforming limit.

In addition to required changes tied to the FHFA's rise in the conventional loan limit for 2018, FHA's loan limits for next year increased in over 3,000 counties because of