Lenders are getting some relief from Federal Housing Administration policies that delay re-inspections of homes involved in pending sales during disasters.

Presidentially declared major disaster areas in Florida are stable enough for re-inspections to begin before the FHA's normally required timeline ends, according to a Sept. 19 FHA bulletin.

The FHA normally requires lenders to wait until the Federal Emergency Management Agency's incident period associated with a disaster ends, but in the case of properties affected by Hurricane Irma in Florida lenders can now get a waiver to start earlier.

However, lenders should be aware more disaster areas could still be added in the state until the incident period, the FHA noted in its bulletin.

The government agency issued the waiver in response to a Mortgage Bankers Association request last week for a tweak to

The FHA timelines cause "needless" delays in some cases and are not in line with how other government-related agencies handle re-inspections, according to a letter that MBA President and CEO David Stevens sent to HUD Secretary Ben Carson on Sept. 15.

Freddie Mac, for example, has called for lenders to re-inspect properties as soon as possible to the extent that it is feasible and that the lender can mitigate enough risk.

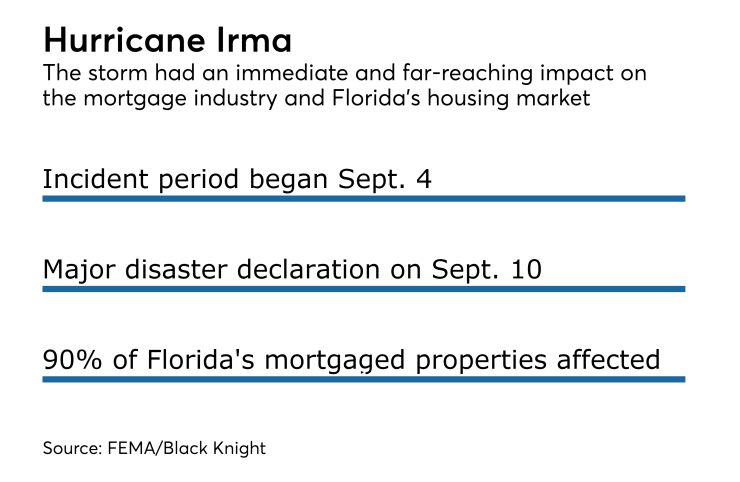

FEMA incident periods vary but can span weeks and may get reopened or extended. Hurricane Irma's incident period began Sept. 4. FEMA's disaster declaration for Florida extends to the entire state, which is a key market for mortgage industry.