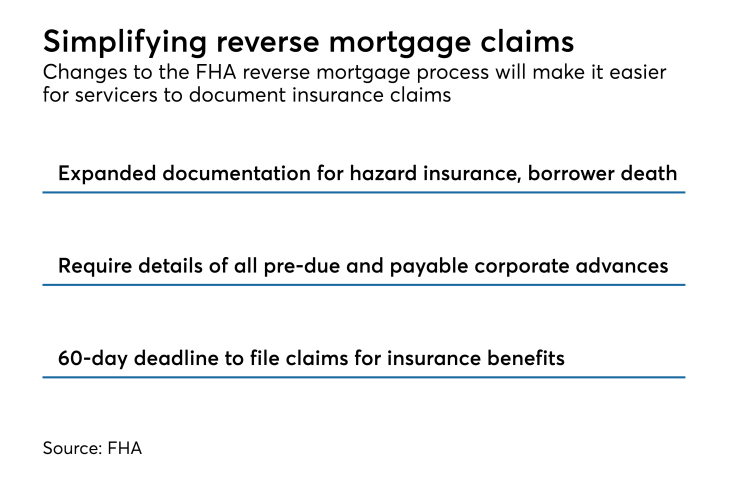

WASHINGTON — The Federal Housing Administration is making it easier for reverse mortgage servicers to submit insurance claims by expanding the types of supporting documentation it will accept on defaulted loans.

The relaxed requirements, which take effect immediately, are designed to give servicers of Home Equity Conversion Mortgages more options when filing claims and speed up the payment process,

The policy changes will also reduce financial burdens on servicers, which typically carry default-related costs on their books until they get reimbursed by FHA mortgage insurance and the foreclosure process.

"Streamlining the HECM claim payment process makes us more responsive to participating lenders and helps continue our effort to put the program on a more financially viable path," FHA Commissioner Brian Montgomery said in a statement.

The FHA will also now require a detailed explanation of all pre-due and payable corporate advances in the compliance package, consisting of the date of the disbursement and the expense that was paid.

The streamlining of documentation requirements will help FHA reduce the time it takes to make claim payments to servicers, the agency said.

Servicers will also now be required to file claims for insurance benefits within 60 days after the preliminary title approval is issued, or the approval will be rescinded.

Since returning as FHA director in June, Montgomery has made