Defaults on first-lien mortgages fell 5 basis points in May from the previous month, dropping to their lowest level in a year.

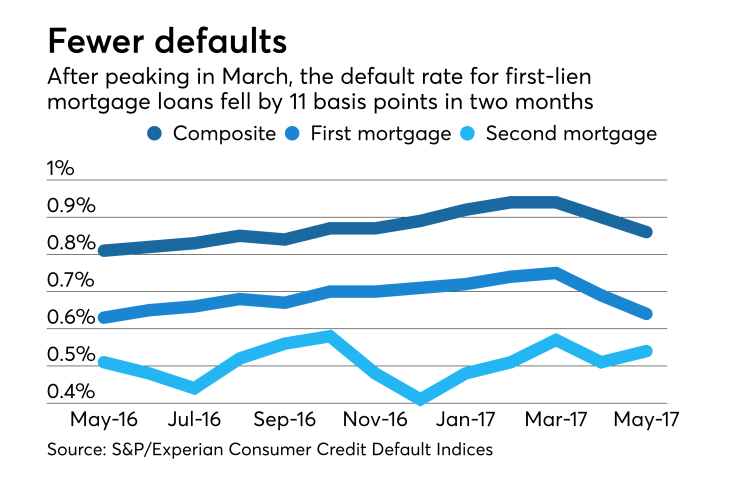

The S&P/Experian Consumer Credit Default Index composite for all four types of loans it tracks — first- and second-lien mortgages, bank credit cards and automobile loans — fell 4 basis points in May to 0.86%.

For first-lien mortgages, the index was at 0.64%, compared with 0.69% in April. The default rate for May 2016 was 0.63%.

This component increased 12 basis points between May 2016 and March, when it reached 0.75%. But in the past two months, first-lien mortgage defaults have declined by 11 basis points.

There was a 3-basis-point increase in the default rate for second mortgages to 0.54% from 0.51% for both April and May 2016.

Defaults for auto loans fell 5 basis points from April to 0.85%.

Credit card defaults rose to 3.53%, an increase of 18 basis points and the highest in 48 months.

"Rising home prices and increases in the equity mortgage borrowers have in their home are helping lower default rates," said David Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices, in a press release.

"One factor in the difference between rising bank card defaults and stable defaults on mortgages and autos may be the difference in interest rates: about 4% on mortgages and 4.4% on auto loans, compared to 12% to 18% on bank card loans."