With coronavirus vaccines introduced and a government stimulus likely to come, forecasts for next year’s housing market and lending environment grew more optimistic in December.

Fannie Mae predicts

Despite a tepid economy

“We also expect housing to remain strong, despite slowing from its previously torrid pace, as homebuilders catch up on current commitments and more existing homeowners list their homes to take advantage of strong price growth,” Duncan said in a press release. “We expect the mortgage market to finish 2020 at a historic level of production before slowing slightly but remaining strong in 2021.”

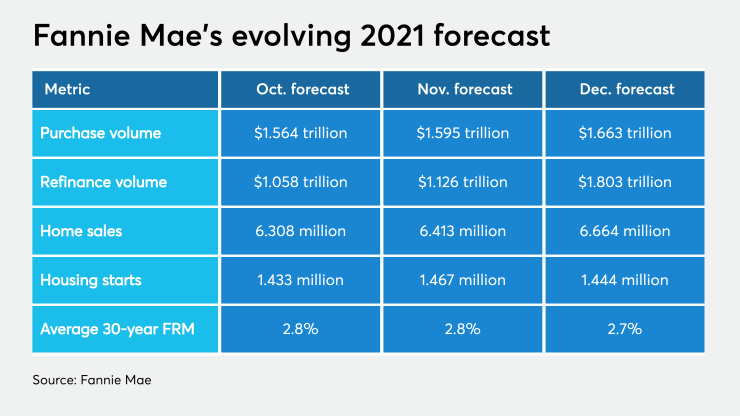

Fannie’s December forecast predicts there will be 1.44 million housing starts in the next 12 months, down slightly from almost 1.47 million it predicted in November. The growth in construction could help to

The GSE expects home sales to climb to nearly 6.7 million, a rise from forecasted totals of 6.4 million and 6.3 million predicted by the agency in the two months. If it reaches that level, it'd surpass the estimated 6.48 million sales in 2020 and 6.02 million in 2019.

Fannie isn’t the only company expecting big things in housing next year. Real estate brokerage Redfin predicts sales to grow 10% annually in 2021 with the most properties bought and houses started since 2006.