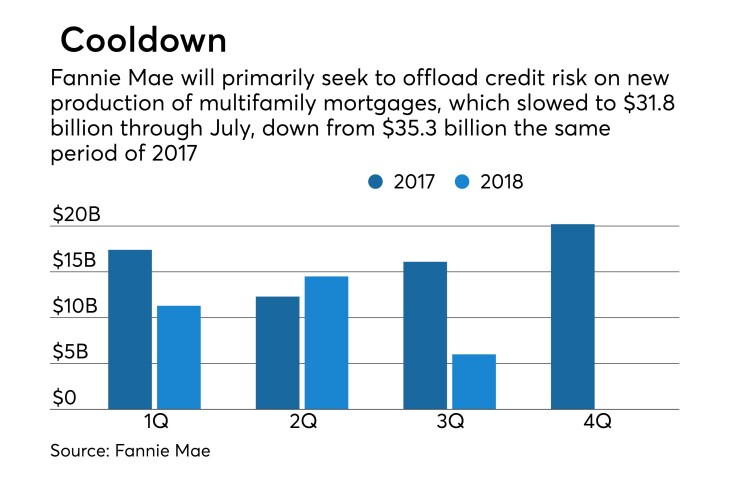

Fannie Mae is reducing its exposure to the risk of multifamily loans that it insures.

The mortgage giant has always offloaded some risk to multifamily mortgages through its designated underwriting and servicing program; it uses the loan as collateral for a mortgage bond, and requires the lender to retain one-third of the risk of default.

Over the past two years, Fannie Mae has been in dialogue with insurers and reinsurers about shedding part of the remaining two-thirds.

On Thursday, the company said it had completed its third reinsurance transaction, and plans to come to market on a regular basis going forward.

The deal, dubbed CIRT 2018-M01, transferred $166 million portion of risk on 1,106 loans totaling approximately $11.1 billion to seven reinsurers and insurers. Each loan has an unpaid principal balance of $30 million or less and was acquired by Fannie Mae from October 2017 through January 2018.

Fannie Mae will retain risk on the first 225 basis points of loss on the pool and reinsurers will cover the next 150 basis points of loss. Once the pool has experienced 375 basis points of losses, the credit protection will be exhausted and Fannie Mae will be responsible for any further losses.

The coverage is for actual losses and lasts for 10 years.

The program is part of the company’s ongoing effort to

Jonathan Gross, vice president, multifamily at Fannie Mae, said the first two multifamily reinsurance deals were done “quietly,” one in 2016 and one in 2017. Through this process, insurers were able to learn more about the government-sponsored entity’s multifamily program, and the GSE was able to learn about insurers’ preferences.

One of these preferences is for deals backed by a larger number of relatively small loans, which reduces the impact of a default on any one loan could result in a large claim on the insurance policy. For this reason, the latest deal excludes any loans larger than $30 million. This kind of structure provides some comfort to investors who may not be as familiar with commercial real estate, since they don’t need detailed knowledge of each property, Gross said.

The $11.1 billion reinsured in the latest transaction is the largest of the three to date, which provide coverage for a total of $28.5 billion (some of that in 2017 and some in 2016). By comparison, Fannie Mae acquired some $67 billion of multifamily loans over the course of 2017.

Gross said Fannie plans to do another multifamily CIRT later this year; going forward, it expects to do two or three deals a year. All of the transactions will reinsure loans that have been recently acquired.

Fannie is also exploring ways to transfer multifamily risk through capital markets transactions similar to its flagship program in the single-family market, Connecticut Avenue Securities, Gross said.

Freddie Mac transfers the majority of risk on multifamily loans that it insures via K-deals, which issue three classes of bonds, senior guaranteed bonds and unguaranteed mezzanine and subordinate bonds. Capital markets investors who purchase the unguaranteed bonds are on the hook for early losses. In 2017, it launched a program offloading risk in bonds that are being