Mixed messages coming out of recent data is making the near-term outlook for the housing market and overall economy difficult to predict, but a recession is still in the cards, according to Fannie Mae.

Elevated interest rates are also likely to remain in the picture for some time, researchers from the government-sponsored enterprise said. Still, despite little chance of mortgage-rate relief this year, Fannie Mae

While inflation slowed in May to 4% on an annual basis, contributing to

"Core inflation remains sticky, having not fallen as rapidly as other price measures, creating upside risk to the fed funds rate as noted in the Federal Reserve's Summary of Economic Projections, and making it likely in our view that it maintains a restrictive posture for longer than most market participants initially anticipated," said Fannie Mae Chief Economist Doug Duncan in a press release.

Any resumption of economic tightening from the central bank would mean interest rates would likely stay near or above current marks.

Recent comments from central bank officials,

But Fannie Mae said it did not expect the Fed to ease monetary policy until inflationary pressures from the labor market pass.

Even with interest rates still higher than many prefer, Fannie Mae left its forecasted home-sales numbers largely unchanged from earlier in the spring. Sales in 2023 and 2024 are expected to total 4.86 million and 4.97 million units respectively, although predictions were made before the recent

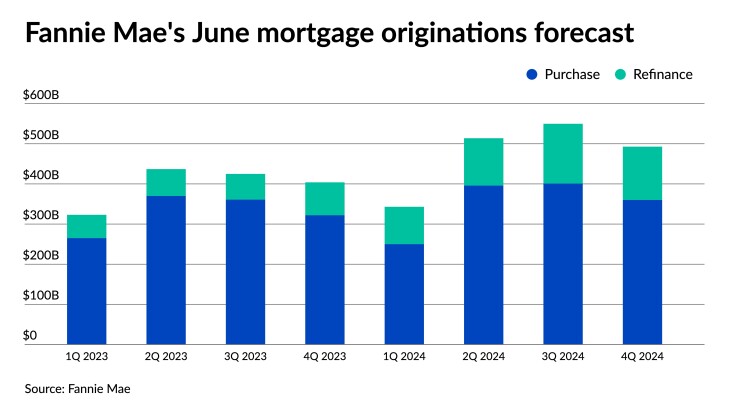

But while sales will remain steady, Fannie Mae revised the forecast for single-family purchase originations downward after its data pointed to a growing share of sales coming in with all-cash offers. Purchase volume is expected to decrease to $1.32 trillion compared to its May prediction of $1.36 trillion. For 2024, purchase origination estimates fell to $1.41 trillion from $1.47 trillion.

Refinances will also fall further. Fannie Mae revised projected volumes downward to $270 billion in 2023 compared to $292 billion a month ago, and to approximately $493 billion next year from May's estimate of $560 billion.

The steadiness of home-sales activity should occur even as data shows signs that

"Housing prices continue to show stronger growth than what was previously expected given the suddenness and significant magnitude of mortgage rate increases," Duncan said.

"Housing's performance is a testimony to the strength of demographic-related demand in the face of baby boomers aging in place and Gen-Xers locking in historically low rates, both of which have helped keep housing supply at historically low levels."

Largely due to the lock-in effect, a

Freddie Mac's researchers struck a more cautious tone in its home-price outlook, saying it was "still too early to separate the signal from the noise fully." The GSE predicted home prices to fall 2.9% year over year by the end of the first quarter 2024, and another 1.3% in the following 12 months.

Meanwhile, the threat of economic contraction still lurks, but with a range of signals coming in from economic data, opinions range regarding its arrival and severity. Since it first forecasted a 2023

In a departure from its previous forecast, Fannie Mae said gross domestic product in the U.S. will increase by 0.1% annually in the fourth quarter. But it also downgraded its expected 2024 degree of growth, leading to its recession prediction.

While others similarly see a recession on the horizon, including the Mortgage Bankers Association, a growing number of

The strength of the U.S. consumer similarly played a part in Freddie Mae's outlook for no recession this year, although it did expect unemployment to move higher.

In the event of a downturn, though, housing could be a bright spot, in part due to the demand for homebuilding, but it would take some time for supply to meet demand, according to the Fannie Mae chief economist.

"We do expect housing will be supportive of the overall economy as it exits the modest recession," Duncan said.