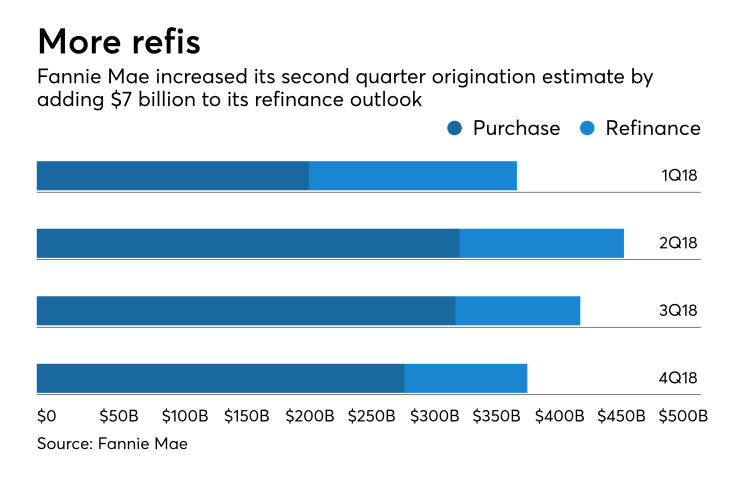

Fannie Mae increased its second-quarter mortgage origination projection by $7 billion as refinance volume is remaining stronger than previously expected.

However, if the rhetoric over foreign trade ramps up, it is possible the U.S. could go into a recession and that would not be good news for housing.

Economic growth should continue at a solid pace, even after consumers were cautious in spending during the first quarter.

"However, downside risks are emerging — the most notable being the increasingly heated rhetoric on trade," said Fannie Mae Chief Economist Doug Duncan in a press release. "If rhetoric becomes reality, a trade war could reverse

Still Duncan believes spending will pick up and the labor market will remain healthy, which means fewer mortgages should become delinquent.

When it came to housing "soft residential investment last quarter should prove temporary, as home sales resume their slow upward grind, with

He still expects the Federal Open Market Committee to raise short-term rates two more times in 2018.

Fannie Mae increased its first-quarter volume estimate by $2 billion

But in the second quarter, Fannie Mae now projects total volume of $473 billion, up from $466 billion last month. Refis are now expected to come in at $132 billion (last month Duncan projected $125 billion), while purchases are still expected to come in at $340 billion.

For the third quarter, Fannie Mae now expects total originations of $436 billion — down from the $440 billion projected in March — and $396 billion in the fourth quarter, compared with $399 billion projected in March.