The Federal Housing Finance Agency changed its mind again about whether to add a limited English proficiency question to the GSEs' loan application, possibly for the last time.

As a result, the government-sponsored enterprises are postponing new Uniform Residential Loan Application and automated underwriting system datasets.

"To allow industry participants time to make the necessary changes, FHFA and the GSEs will be extending the deadlines for implementation of the URLA and AUS datasets; the mandatory use of the redesigned form will no longer begin on Feb. 1, 2020," the GSEs said in a joint statement.

The agency directed the GSEs to make other changes as well, including the deletion of a homeownership education and counseling question, the expansion of a section about the "use and sharing of information" and the relocation of a military service question to another part of the form.

But it's specifically the language question that has been an issue before.

Under former Director Mel Watt, the FHFA repeatedly wavered on whether to add it to the new application.

Now that the agency is under

The agency first considered adding the language question when it began working with Fannie Mae and Freddie Mac to revise the URLA.

But when it ran into unspecified financial industry opposition in 2016, Watt

Despite this concern, the FHFA later reconsidered the idea of adding a language question again, and issued a

The Mortgage Bankers Association responded by explaining why it

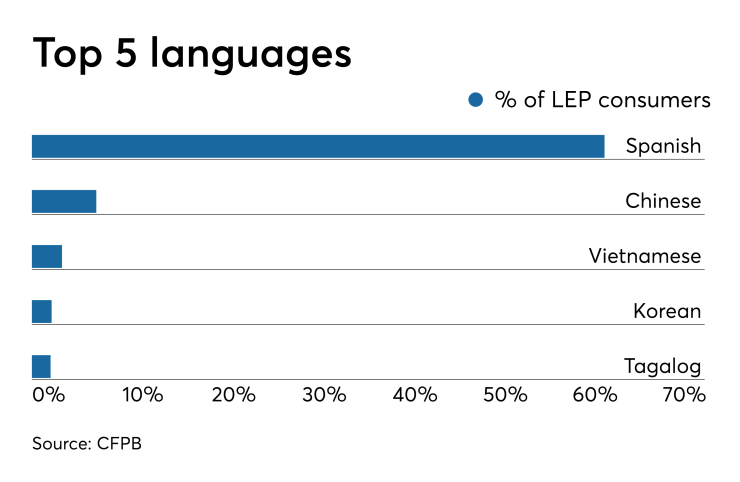

While the majority of LEP borrowers in the United States

After hearing the MBA's concerns, the FHFA

Regardless of whether lenders are required to include a language question on GSE loan apps, they may be interested in finding ways to expand their customer bases by marketing to people with limited English proficiency. These consumers represent