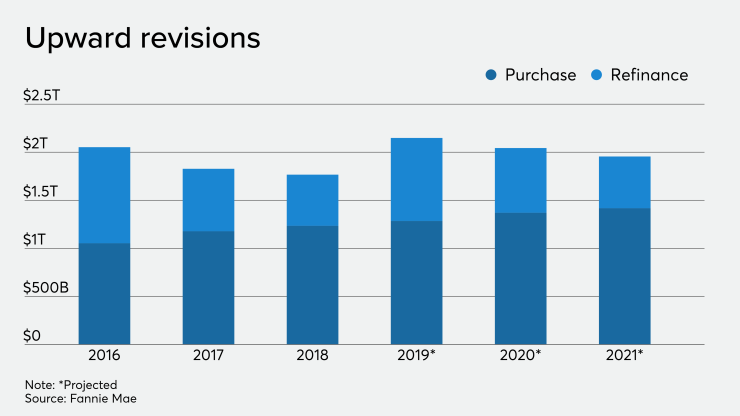

With housing projected to grow hand-in-hand with the economy, Fannie Mae boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

Compared to projections from

"Housing appears poised to take a leading role in real GDP growth over the forecast horizon for the first time in years, further bolstering our modest-but-solid growth forecasts through 2021," Doug Duncan, Fannie Mae's senior vice president and chief economist, said in a press release.

"In our view, residential fixed investment is likely to benefit from ongoing strength in the labor markets and consumer spending, in addition to the low interest rate environment. Risks to growth have lessened of late, as a 'Phase One'

Fannie anticipates

The GSE also expects the 30-year fixed mortgage rate to drop off, finishing 2019 at an average of 3.9%, then falling to 3.6% in 2020 and 2021.

"Our expectation that residential fixed investment will function as an ongoing engine for growth is driven primarily by the improvement in our forecast for the single-family market," Duncan said.

"We now expect single-family housing starts and sales of new homes to increase substantially, aided by a large uptick in new construction as builders work to replenish inventories drawn down by the recent surge in new home sales activity. Despite the expected increase in the pace of construction, the supply of homes for sale remains tight and strong demand for housing is continuing to drive home prices higher, particularly in the more entry-level price tiers. This stronger price appreciation is also having the unfortunate effect of partially offsetting savings to potential homebuyers