Borrowers who have mortgage payments made by someone else may be able to exclude the entire monthly housing expense from debt-to-income calculations, according to a Fannie Mae update.

"When a borrower is obligated on a mortgage, but another party has been making the mortgage payments, the lender may exclude the full monthly housing expense from the DTI ratio, provided the borrower is not using rental income from the applicable property to qualify," according to the update.

"The mortgaged property must still be included in the borrower's multiple financed property count and the unpaid principal balance for the mortgage must still be included in the calculation of reserves for multiple financed properties."

Fannie in July began excluding from the DTI ratio mortgage payments paid on-time by someone else who is also obligated on the loan.

The update on Oct. 31 clarifies that the exclusion extends to the full monthly housing expense including the principal amount, interest, property taxes, homeowners insurance and association dues.

Lenders must obtain the most recent 12 months' cancelled checks or bank statements from the other party making the payments to document a 12-month payment history with no delinquent payments, according to Fannie Mae.

Fannie Mae in July

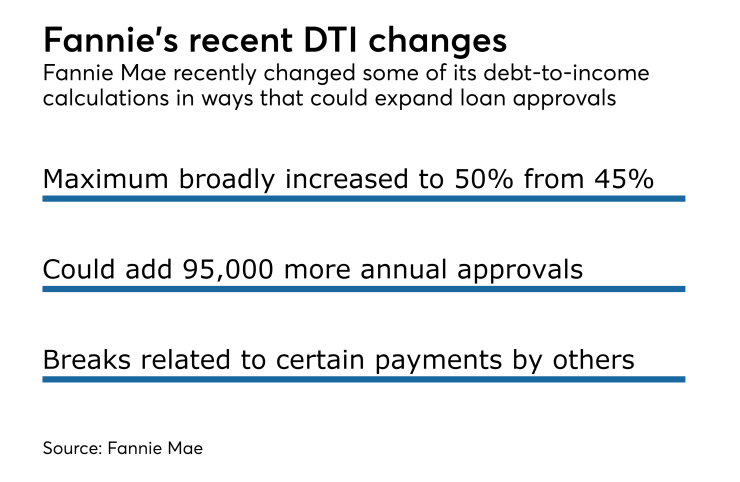

The increase in the maximum DTI Fannie allows could increase the number of annual loan approvals by 95,000, the Urban Institute estimates.