Government-sponsored enterprise Fannie Mae this week issued guidance on the timelines for procedures related to asking borrowers about post-forbearance disaster payment deferrals in circumstances where a loan has been delinquent for 12 months.

Among other things, the new guidance issued Wednesday makes it clear that when a servicer solicits a borrower that hasn’t paid in a year, the consumer must make one regular monthly payment based on the current written terms of the loan in good faith. Thereafter, the borrower may be evaluated for a deferral in which their payments may be temporarily suspended and tacked onto the end of the loan.

The guidance was important because there have been Consumer Financial Protection Bureau concerns about the issue and

“This clarification may help to reduce the number of CFPB complaints regarding the timing and details of deferral eligibility,” Keys said in an email.

In addition to clarification around the payment, mortgage servicers had requested guidance related to when the deferral must be completed and whether they could get additional time for it to accommodate their processing month, she said.

The guidance states that the deferral must generally be completed within the month the mortgage company solicits the delinquent borrower for one, and after the receipt of the borrower’s payment, but servicers can get some leeway for their processing month.

“Communication issues related to forbearance plans and options available at the end of these plans” was one of the common themes in the CFPB’s

“There’s still work to be done when it comes to being really clear with borrowers. You can see that with the COVID-19 deferral plan, and now that we’re in hurricane season, I think this will be relevant for disaster payment deferrals as well,” Keys said in an interview.

The guidance from Fannie will be helpful to this end. The GSE guarantees payments from mortgages they buy from lenders after those loans are securitized and sold as securities to a large, global investor base, so it has some strict rules around how to handle situations in which borrowers go delinquent. Those rules are influential because the loans Fannie buys account for a large percentage of mortgages sold in the U.S.

Delinquencies typically start to convert to foreclosures after 90 days, but with forbearance for coronavirus-related hardships on government-related loans extended for more than a year, lengthy payment suspensions are increasingly possible. At the same time,

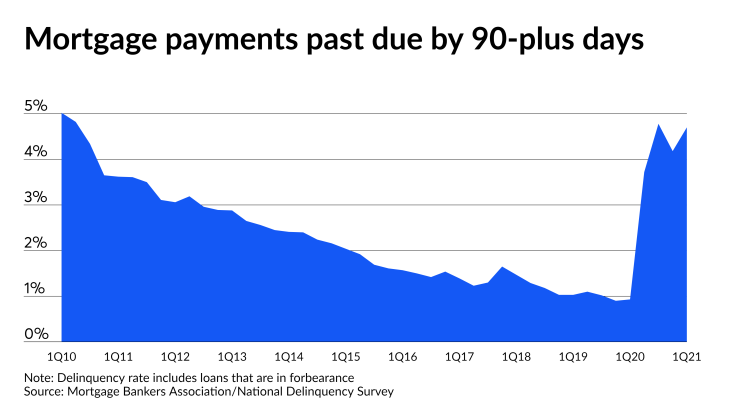

While there’s been some recovery in the numbers for longer-term delinquencies due to government assistance and a vaccine rollout that’s allowed the economy to open up, they remain historically high.

In the first quarter, 4.7% of all mortgages were 90-or-more days late, down 33 basis points from the previous fiscal period, according to the Mortgage Bankers Association’s national survey of its members. However, that first-quarter 2020 number was up more than 3% or 303 basis points from the first quarter of last year.

The serious delinquency rate has not been this high since the second quarter of 2010, when it was 4.82%. Serious delinquencies peaked in the first quarter of that year at just over 5%.