Fannie Mae again increased its mortgage origination forecast for this year, with higher-than-expected refinancings and higher home prices more than offsetting a cut in home sales compared with

The government-sponsored enterprise's July economic outlook calls for $4.36 trillion in mortgage originations, with $2.52 trillion coming from refis. It forecast $4.2 trillion in total volume, with $2.37 trillion of refis in June. Because of the

Still, "for the housing market, at current case levels, the lack of inventories of homes for sale and continued supply chain bottlenecks experienced by homebuilders remain the primary constraints on home purchase activity," Mark Palim, Fannie Mae deputy chief economist, said in a press release. "Moreover, while mortgage rates have drifted downward and in theory provide greater purchasing power to potential borrowers, in practice, given current supply-side and affordability challenges, we expect that benefit to be limited."

Reflective of

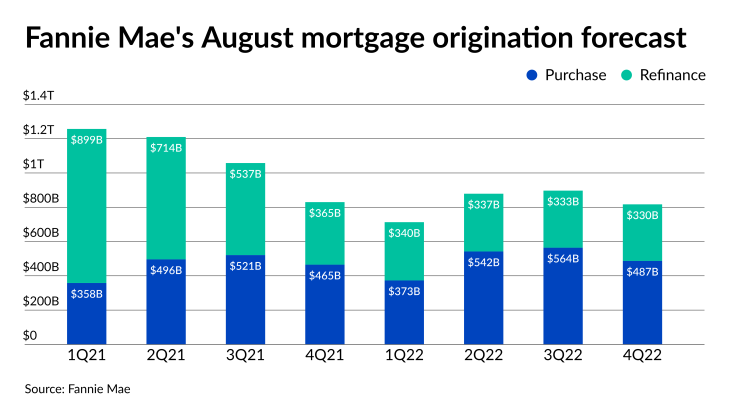

Fannie Mae now projects $830 billion in fourth quarter volume, with a 44% refi share. That shot up from $797 billion and 42% refi a month ago.

Total

Fannie estimates the median new home sale price to hit $384,000 for the year, compared with $335,000 one year ago, while the median existing

The latest forecast calls for the 30-year fixed-rate mortgage to remain below 3% for the rest of the year, at 2.8% for the third quarter and 2.9% for the fourth. Last month's outlook expected rates to reach 3.1% by the end of 2021.

Fannie Mae also dropped its interest rate forecast for 2022, to 3.2% by the fourth quarter from the prior outlook of 3.3%. That led the GSE to raise its 2022 forecast to $3.31 trillion in the July report from June's $3.23 trillion. The change in the forecast comes from more refis than previously expected, at $1.34 trillion in July versus $1.27 trillion in June.