Government-sponsored enterprise Fannie Mae has added a new timing restriction for cash-out refinances that will become mandatory on April 1 following a similar move by competitor Freddie Mac.

Fannie has

Freddie Mac's similar change is set to go into effect for mortgages with settlement dates on or after March 7.

When timing restrictions are set on refinances, it's often an attempt to prevent excessive churning of loans. The GSEs also may want to manage the risks related to equity withdrawal in a market with some softening in housing prices.

The addition of the restrictions is occuring amid broader changes at the two government-related mortgage investors, which back a significant number of the mortgages originated in the United States. These changes include a

Adding the new restriction related to the timing for cash-outs increases the concern for consumers in that market, which has been under an increasing amount of pressure, said Mat Ishbia, CEO of United Wholesale Mortgage.

Not only are cash-out borrowers facing new GSE restrictions related to timing and pricing, but the loans also have been less desirable because many existing first-lien borrowers got their mortgages when rates were lower in 2020 and 2021.

"Cash-outs are more expensive, cash-outs are harder to do…these things are making it harder for the cash-out refinance for consumers," Ishbia noted in a recent online video commentary.

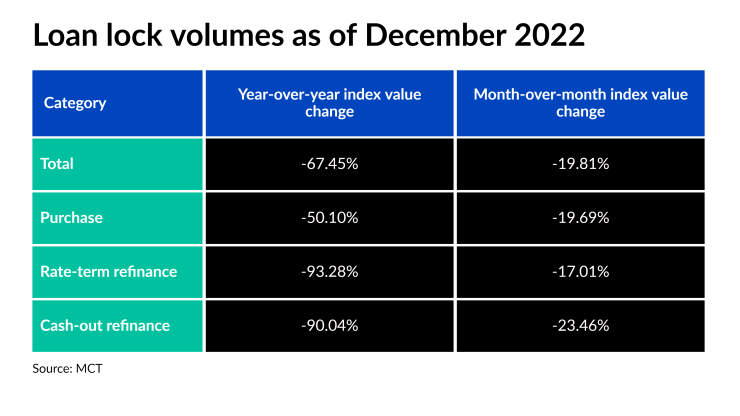

The number of borrowers that locked rates for cash-outs in 2022 was down 90.04% from the year before, as compared with a 67.45% annual decline for the market as a whole, according to Mortgage Capital Trading's most recent index reading. The contrast in year-over-year numbers moderated a bit in December as a near-term rate drop occurred, and potentially because of some interest in getting into the cash-out market ahead of the fee hike.

The cash-out fee adjustment stems from

While

Mortgage industry leaders have expressed some hope the FHFA could revisit those requirements in light of their concerns about their impact on mortgage pricing.

The National Association of Mortgage Brokers, for example, has issued a statement about the change in loan-level price adjustments indicating that while it "understands the difficult decisions which face FHFA…NAMB feels the pending LLPA fees changes will have a significant impact on homeowners, especially the middle-income borrowers."

"The LLPA fees' increase will result in fewer families being able to purchase and refinance their homes in many cases," said Ernest Jones Jr., board president of the association, in an emailed statement.

Overall, Ishbia said he sees the FHFA's changes as ones that are going to "hurt some borrowers, help some borrowers.

"Do I love how they handled it? Not really, but I do understand what they're trying to do. It's just hard to hurt some of these consumers that are doing things the right way to help some of those who need a little extra help," he said.