As lenders aim to become less

Grind Analytics, a business intelligence fintech, recently launched an employee productivity scorecard, MODM or Master Operations Decision Medium. The software uses artificial intelligence and company-provided benchmarks to

“Our clients have about 90% of their staff working from home. You're looking at 68% of your costs — your employees — that you now have much less ability to manage,” Tim Armbruster, CEO of Grind Analytics, said in an interview.

“What we're seeing when we initially deploy this solution is that there's a big disparity in performance between employees — much larger than you would think — and that corrects itself within one to two months.” he said.

The scorecard’s early returns show effectiveness, albeit from a very small sample size, Armbruster said. San Diego-based Grind worked with a pair of lenders in the development of the product. Those lenders — OneTrust Home Loans and another who asked to remain unidentified — have used a beta version of the scorecard since the middle of 2020.

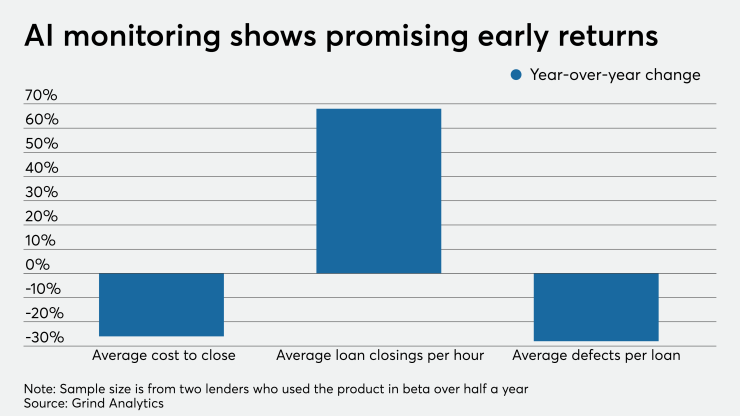

Since implementation, those lenders cut down their average costs to close to 26% from the year prior, Armbruster said. Additionally, their efficiency improved with average closings per hour jumping 68% and the number of defects per loan dropping 28%.

Accounting primarily for compensation, the cost per closed loan at OneTrust dropped to about $3,800 from $4,500 over the course of 2020, according to company president Shane Erskine. Defects per closed loan — the benchmark Erskine deems most important — decreased to an average of 0.71 in December from 1.19 in January.

“We're not really looking at this as disciplinary, it's more to enhance and improve,” Erskine said. “We have an initiative to reduce our loan costs by over 50% over a five-year window and without the transparency, there's really no way for us to do that.”

The scorecards helped Erksine’s team identify inefficiencies while also providing hard data upon which to base employee evaluations.

“The employee scorecard keeps everybody honest,” he said. “When it comes time to do quarterly or annual reviews, that makes it easy for the management team and our individual employees to see how they're performing.”

However, use of employee monitoring software can lead to complaints about an invasion of privacy. Armbruster is fully aware of this perception. While detecting and categorizing employee computer activity can be controversial, he thinks it’s an important tool for lenders to have in place.

“That's something you have to be straightforward about with your employees and make them understand that when you're logged into a work computer, we have analytics and metrics that tell us what you're doing,” Armbruster said. “It's a new world and I think each company is going to treat that differently. You want to make sure that you understand what you legally can and can't do.”

“We believe that