Intercontinental Exchange has priced a series of debt offerings totaling $6.5 billion to finance the cash portion of the purchase of mortgage technology company Ellie Mae.

The transaction is

In addition to the notes, ICE will turn to the issuance of commercial paper and/or borrowings, using a new senior unsecured term loan facility to finance the cash portion of the deal.

According to Moody's, the total amount of debt needed to pay for the deal will be $9.25 billion. An Aug. 7 downgrade of ICE's ratings noted it would more than double the size of the company's debt.

"In previous large acquisitions of IDC in 2015 and NYSE Euronext in 2013, ICE demonstrated a strong track record in achieving its committed delevering targets," Donald Robertson, Moody's senior vice president, said in a press release.

"However, ICE's pro forma initial leverage will be significantly worse than for these previous deals that were each below three times and consequently it will take longer to delever, thereby exposing creditors to incrementally more credit risk," said Robertson.

Moody's cited ICE's "corporate behavior" in funding deals with large amounts of debt.

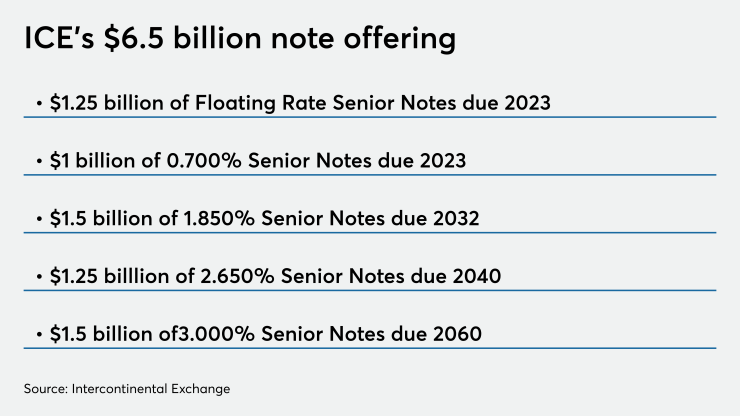

The $6.5 billion aggregate senior note offerings (see chart) consist of $1.25 billion of Floating Rate Senior Notes due 2023, $1 billion of 0.700% Senior Notes due 2023, $1.5 billion of 1.850% Senior Notes due 2032, $1.25 billion of 2.650% Senior Notes due 2040 and $1.5 billion of 3.000% Senior Notes due 2060.

The joint book-running managers are BofA Securities, JPMorgan Securities, Wells Fargo Securities, MUFG Securities Americas, Citigroup Global Markets and Credit Suisse Securities (USA). The senior co-managers are BBVA Securities, BMO Capital Markets, Fifth Third Securities, Mizuho Securities USA and PNC Capital Markets, while the co-managers are Goldman Sachs and SG Americas Securities.

Among ICE's existing mortgage subsidiaries are Merscorp Holdings and Simplifile.

But ICE isn't the only company turning to the debt markets to raise money to fund an acquisition.

On Aug. 12, Black Knight InfoServe, an indirect, wholly owned subsidiary of Black Knight, priced an issuance of $1 billion of 3.625% Senior Unsecured Notes due Sept. 1, 2028.

Black Knight is a competitor to Ellie Mae, primarily in loan origination systems, but also in data and analytics.

The proceeds will be used by Black Knight to finance part of the cash portion of the purchase of Optimal Blue Holdings, which owns a product and pricing engine.

The issuance total was a $250 million increase from what Black Knight first announced. The notes will pay interest semi-annually on Sept. 1 and March 1, commencing March 1, 2021, and maturing on Sept. 1, 2028.

They will be guaranteed on a senior unsecured basis by Black Knight, by BKIS's direct parent entity and substantially all of BKIS's wholly owned restricted subsidiaries that guarantee its credit facility. The offering is expected to close on Aug. 26, 2020.

Black Knight plans to use cash on hand and additional borrowings under its revolving credit facility for the rest of the cash portion.

The deal is

The notes are being sold via a private offering memorandum. The offering is not subject to the completion of the Optimal Blue deal, but there is a mandatory special redemption if it doesn't take place.