Consumer worries over the direction of the U.S. economy affected mortgage application activity this past week even as interest rates remained flat or declined, according to the Mortgage Bankers Association.

Total application volume decreased 3.3%

"Concerns over European economic growth and ongoing uncertainty about a trade war with China were some of the main factors that kept mortgage rates low last week. Even with lower rates on three of the five surveyed loan types, refinance activity fell 6%, essentially reversing an 8% increase the week before," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release.

"Purchase applications decreased for the third straight week, but remained more than 7% higher than a year ago. It is possible that the trade dispute is causing potential homeowners to hold off on buying, with the fear that further escalation — or the lack of resolution — may have adverse impacts on the economy and housing market."

The seasonally adjusted purchase index decreased 1% from one week earlier, while the unadjusted purchase index decreased 3% compared with the previous week.

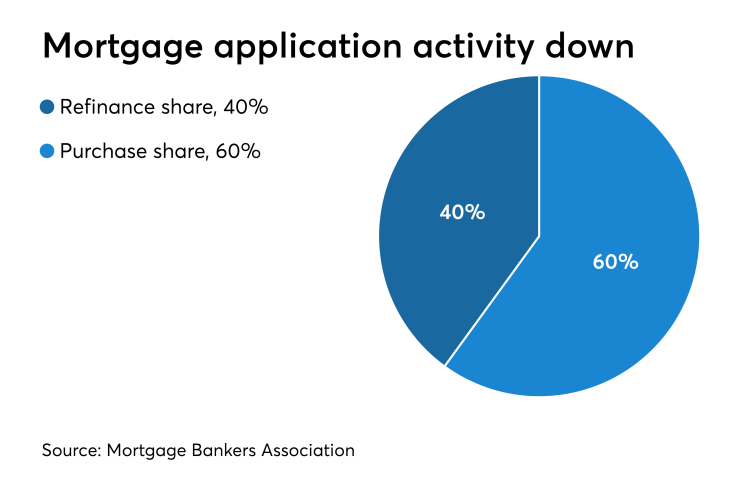

The refinance share of mortgage activity decreased to 39.7% of total applications from 40.5% the previous week.

Adjustable-rate loan activity decreased to 6.6% from 6.8% of total applications, while the share of Federal Housing Administration-insured loan applications increased to 9.6% from 9.4% the week prior.

The share of applications for Veterans Affairs-guaranteed loans increased to 11.2% from 11% and the U.S. Department of Agriculture/Rural Development share increased to 0.7% from 0.6% the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) remained unchanged from 4.33%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $484,350), the average contract rate decreased 6 basis points to 4.18%.

The average contract rate for 30-year fixed-rate mortgages backed by the FHA decreased 1 basis point to 4.33%. For 15-year fixed-rate mortgages, the average decreased 5 basis points to 3.73%. The average contract interest rate for 5/1 ARMs increased to 3.74% from 3.57%.