As expected economic growth remains at 2.2% — down from 2018's 3.1% — 2019 should only be accompanied by a solitary rate hike from the Federal Reserve, according to Fannie Mae.

Fannie estimates the average 30-year fixed-rate mortgage to edge down to 4.4% through 2019 and 2020, according to the February housing forecast. That's down from

"We reduced first-quarter growth expectation slightly, but our forecast for full-year 2019 growth remains unchanged," Doug Duncan, chief economist at Fannie Mae, said in a press release.

"The labor market is strong, unemployment is at a very low level historically and wages are rising modestly, enticing workers to come off the sidelines. We continue to expect only one rate hike this year as markets applauded the pause in monetary tightening by the Fed. Uncertainty regarding terms of trade remains a downside risk, as does slowing global economic growth."

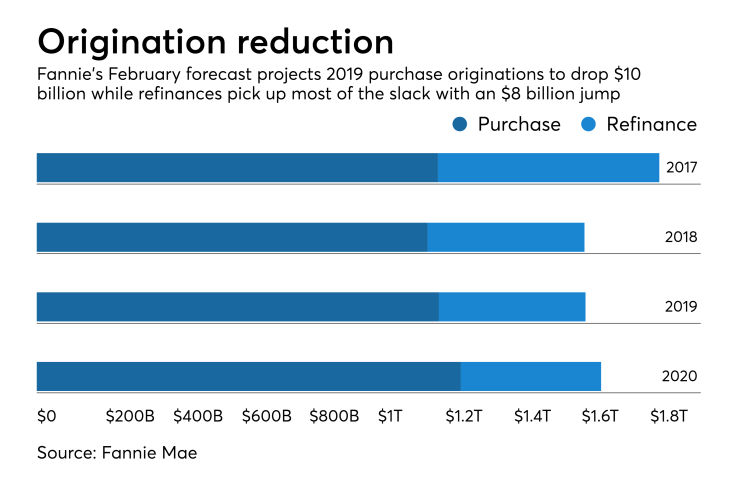

The government-sponsored enterprise's February forecast shows mortgage origination volume for 2018 ending at a shade under $1.61 trillion and staying flat in 2019 before jumping to $1.66 trillion in 2020. The 2019 purchase total is projected at $1.18 trillion while the refinance volume sits at $431 billion, a share of 27%. Purchase volume in 2020 is projected to hit $1.25 trillion with the refinance total falling to $411 billion, or a 25% share.

"On housing, a reduction in our forecast of existing-home sales has our team projecting fewer 2019 purchase mortgage originations. However, falling — or at least not rising — interest rates, strong employment, continued wage growth and a deceleration in home price appreciation should support more favorable home buying conditions heading into the spring, along with improved affordability," Duncan said.

Total home sales should remain relatively flat in 2019 with a projected 0.2% growth from 2018. However, sales in 2020 should grow by 2.2% with over 6.1 million units anticipated to be sold.