Fannie Mae estimates the average 30-year fixed-rate mortgage to hold at 4.4% through 2019 and 2020 due to the overall slowdown in the economy, according to the March housing forecast.

That stayed in line with

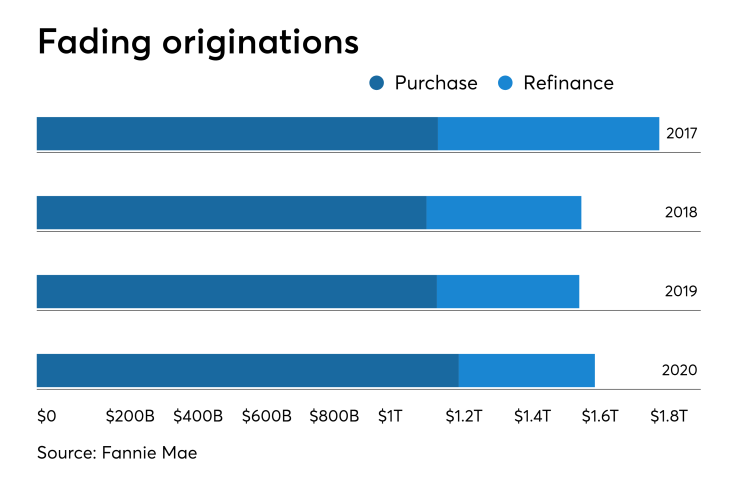

The government-sponsored enterprise's March forecast shows mortgage origination volume ended at an even $1.6 trillion in 2018, and will drop off a bit in 2019 to $1.59 trillion before stepping up to $1.64 trillion in 2020. The 2019 purchase total is projected at $1.18 trillion while the refinance volume sits at $417 billion — a 26% share. Purchase volume in 2020 is projected to hit $1.24 trillion with the refinance total falling to $399 billion, or a 24% share. All projected figures decreased from a month ago.

"We continue to expect another year of steady home sales in 2019," Doug Duncan, chief economist at Fannie Mae, said in a press release. "While inventory has improved, it remains low by historical standards — particularly among existing homes — and threatens to derail the spring home buying season, though a recent jump in single-family starts suggests that new supply is on the way. Considering the general inventory shortage and strong demand for housing, affordability remains a key challenge facing the industry, particularly in the conforming space."

Total home sales should stay nearly identical in 2019 with growth from 2018 only projected at 0.1%. However, sales in 2020 should grow by 2.4% year-over-year with about 6.1 million units anticipated to sell. The jump in 2020 housing starts to 1.29 million from the 1.26 million estimated for 2019 will help the progression. The expected 1.3% annualized economic growth for 2019's opening frame is the slowest quarterly rate in over three years and could cause the Federal Reserve to hold off on any hikes.

"Growth is clearly on the decline, in line with our projection for 2.2% in 2019," Duncan said. "As we weigh the downside risks to the economy — including moderating international growth and trade uncertainty — we now project that the Fed will wait until the fourth quarter to raise rates, if at all. However, some ground may have been broken on a path to improved growth, as productivity rose by 1.8% annually last quarter — a clear step above the well-trodden 1% to 1.4% band of the last few years."