Some commercial mortgage-backed securities due next year could have difficulty refinancing due to the recent Ridgecrest, Calif., earthquake, according to a new Morningstar report.

There are approximately $3.2 billion in securitized commercial mortgages "at elevated risk" in the area around the epicenter in Ridgecrest.

Initial defaults should remain low because of business interruption insurance policies supporting affected properties, but "property damage could prevent refinancing some existing loans and jeopardize the payoff of roughly $259.5 million in securitized loans that mature over the next 12 months,"

However, "ultimately, if a property is operating, meeting its debt obligations, and has no lasting earthquake-related fallout,

Morningstar found 298 properties backing 288 securitized loans in Kern and San Bernardino counties that could have significant damage from the July 4 and 5 earthquakes. Of the 10 largest loans in Morningstar-rated CMBS in the two counties, nine were current at the time of the earthquakes.

While Morningstar and

Although Fitch considers coverage sufficient, it indicated it will continue to monitor the situation.

"We expect to receive significant insurance event reports from CMBS master servicers within two to three weeks of events. These reports track the status of insurance claims and repairs, if needed," the ratings agency said.

The U.S. is broken out into several categories of seismic zones — measurements of possible ground movements during an earthquake — with zones 3 and 4 having the highest ground acceleration level; all of California is in one of these two zones.

Separate earthquake insurance is required for properties located in seismic zones 3 or 4, Fitch said. "If the probable maximum loss is greater than 20%, then insurance should be in place to cover the property's replacement cost.

"Fitch's analysis of loans with properties located in seismic zones 3 and 4 have a higher probability of default than those of properties located in seismic zones 1 or 2.

"If the PML is greater than 20%, our modeling assumes there is earthquake insurance in place to cover the property's replacement cost. If such insurance is not in place to mitigate the risk, the probability of default may be increased, depending on such factors as property type, construction quality and the degree of retrofitting," the report said.

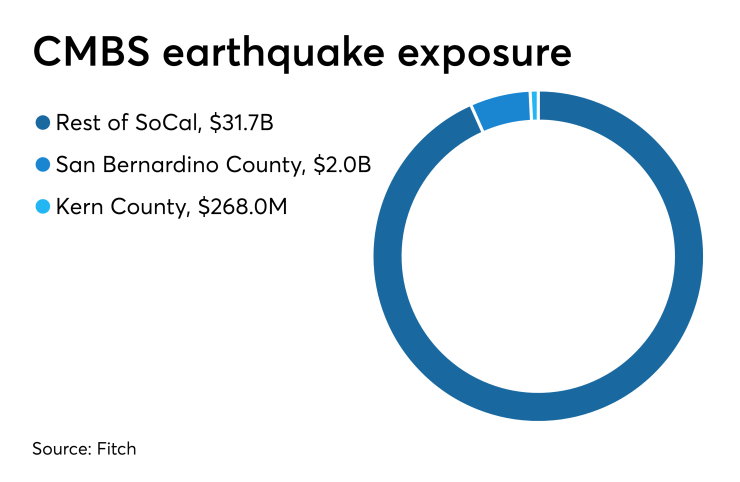

Out of $34 billion of Fitch-rated CMBS exposure in Southern California, $268 million is in Kern County and $2 billion in San Bernardino County.

For residential mortgages, the level of defaults also is expected to be modest, if borrower behavior following a natural disaster follows the pattern seen over the last 30 years, according to Fitch.

"The relatively limited amount of time residential borrowers have been affected by natural disasters in recent decades was mitigated by private insurance, federal disaster funding and stimulus to the economy driven by the recovery, such as construction and repair work."

Residential mortgage delinquency levels for an affected area return to normal levels within a 12-to-18 month period.

But going forward, "Fitch recognizes that future natural disasters may be more severe than those experienced over the past 30 years, potentially resulting in a longer, and more significant, impact on borrower mortgage performance.

"To help