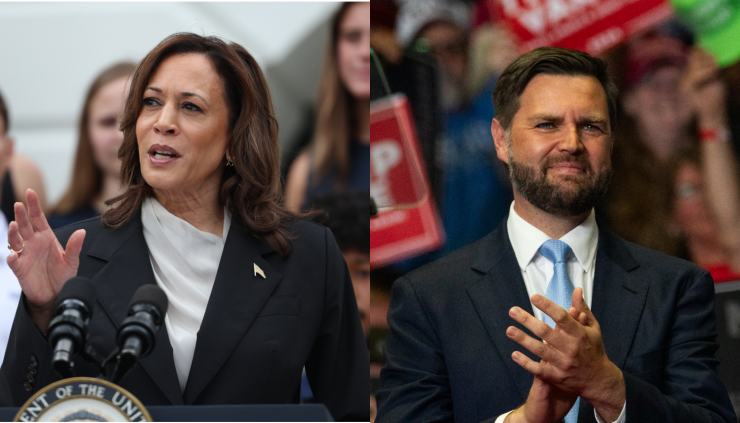

WASHINGTON — As the political world settles from a week that's turned the 2024 presidential election on its head, economic visions from both parties have started to come into focus.

Former President Donald Trump and

Vance expanded on that message Monday in his first solo appearance as Trump's running mate in a speech in his old high school gymnasium in Middletown, Ohio.

"We're going to fight for every single worker in this country," he said. "If you work hard and play by the rules, you ought to be able to put a good dinner on the table and send your kids to whatever vacation and whatever school you want. To work hard and play by the rules, you get a good life. It's that simple."

The Trump-Vance campaign message also took a more sharply nationalist tone during the Republican National Convention last week, and since.

"We are done, ladies and gentlemen, catering to Wall Street," Vance said at his speech at the Republican National Convention last week. "We're done importing foreign labor, we are going to fight for American citizens and their good jobs and their good wages."

Brian Gardner, chief Washington strategist for Stifel, said that the long-term implications of this growing strain of populist thought among Republicans poses a problem for the banking industry — or, more specifically, for larger banks.

"I think community banks will be fine, the populists will actually lean into community banks even more than we've seen before," he said. "I think it's a big problem for the Wall Street banks, where not only are some of the populists not aligned with the largest banks, there's some open hostility."

To be sure, Gardner said that's likely more of a signal as to where the Republican party heads after Trump rather than an indication of where a potential Trump 2.0 administration would land on issues important to the financial industry, such as tax policy.

By contrast, Harris' ascent represents less of a departure from the policies and ethos of her party when it comes to economic issues. She has, for the last three and a half years, focused on promoting the Biden administration's priorities, which have included lending her stature to elevate some issues at the

Overall, Harris is expected to promote Democrats' "new economic thinking," said Suzanne Kahn, vice president of Roosevelt Forward, the advocacy arm of the Roosevelt Institute. That includes issues like unequal economic opportunity among various groups and public options for things like child care and health care.

Regulation, including for banks, plays a role in this new economic thinking as well, she said.

"Another place we've seen this administration be strong — and I would expect to see a Harris administration be very strong on — is antitrust and reigning in corporate power," she said. "I think that's something the FTC and the CFPB have gone very hard on."

Kahn said that Harris should be able to run on those ideas "without the baggage" weighing down Biden, who's been blamed by Republicans for high prices in consumer goods since the spike in inflation took off in 2021.

Perhaps the most stark contrast between the two parties' economic visions will play out in tax policy. Whichever candidate prevails in November will have to champion significant tax legislation through Congress next year, as many of the tax cuts that Trump signed into law during his first term are set to expire.

Trump has touted higher tariffs that he says will protect American jobs and goods, and has in campaign speeches broadly said that he would extend many of the cuts. He's also reportedly told donors that he wouldn't turn to a financial transactions or stock buyback tax to make up for revenue losses incurred by making the tax cuts permanent.

Harris has a slightly more progressive record than Biden. During 2020, she called to repeal Trump's tax cuts for corporations, which would have reverted the top rate back up to 35% from the post-Trump level of 21%. Biden, for his part, called for raising the corporate rate to 28%.

Ian Katz, managing director at Capital Alpha Partners, cautioned that Harris isn't more likely than another Democrat to enact those tax hikes.

"If she were president, I don't think she would be spending much time or energy on things like a transaction tax or stock buybacks," he said. "I don't think any president ever has. If she did, it would be situational and transactional."