Intense competition among homebuyers remains as shown by the continual growth of median down payments, according to Attom Data Solutions.

The median down payment on single-family homes and condos purchased with financing continues climbing, reaching a new high-water mark since the data's 2000 origin. The third quarter of 2018 had a median of $20,250, up 16% year-over-year and up 7% from

"Despite all the signs of cooling demand, the rising down payment percentage is evidence that this housing market is still quite competitive and lending standards are not substantially loosening in response to that weakening demand," Daren Blomquist, senior vice president at Attom, said in a statement to NMN.

The third-quarter down payment figure was 7.6% of the median sales price, marking the highest percentage since the fourth quarter of 2003. It's a rise from the 6.8% share from a year ago and last quarter's 7.2%.

"Rising mortgage rates may even be prompting buyers to put more down in an effort to lower their monthly payments and secure a more palatable debt-to-income ratio — both for them and for their lender," Blomquist said.

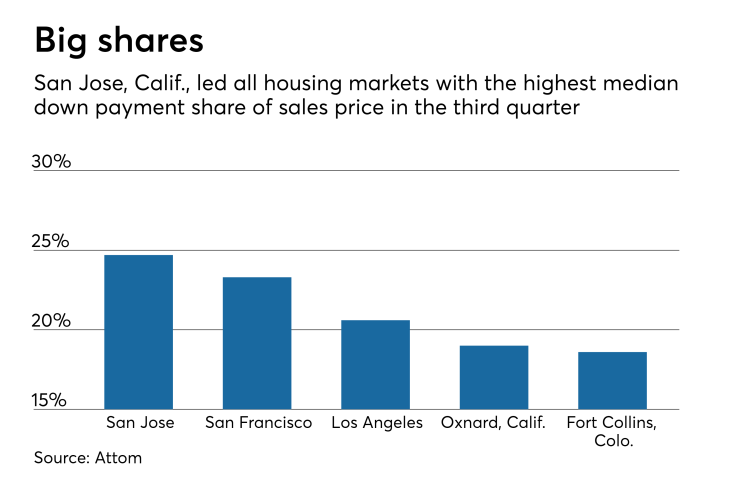

San Jose, Calif., led all housing markets by down payment percentage of sales price at 24.7%, with San Francisco at 23.3% and Los Angeles right behind at 20.6%.

While median down payments hit a new high, mortgage originations declined annually for the fourth consecutive quarter. The third quarter's 892,760 purchase mortgage originations fell 2% year-over-year and 5% quarter-over-quarter.

"Rising mortgage rates continued to dampen demand for mortgages in the third quarter, particularly refinance mortgages," Blomquist said in a press release. "There were some notable exceptions to that trend, primarily in markets affected by the hurricanes in the third quarter of 2017."

The volume of home equity lines of credit also dropped. The third quarter's 313,744 HELOCs was an 11% year-over-year decline and down 14% from last quarter.