Nearly $30 billion of Federal Housing Administration mortgages may be at risk because they relied on so-called borrower-financed down-payment assistance, according to a new federal report.

At issue is assistance provided by state housing finance agency programs, which borrowers receive by agreeing to pay higher interest rates on their mortgages. Those bigger monthly payments raise the odds of default to the point of putting the Mutual Mortgage Insurance Fund at risk, said the report, which compares the state programs with seller-funded down-payment assistance that has been banned.

Moreover, the assertions threaten to reignite a long-simmering battle between the Department of Housing and Urban Development and its inspector general’s office — the author of the report.

The clash began nearly two years ago. In July 2015, the HUD inspector general audited Nova Financial and Investment of Tucson, Ariz., and two months later it issued results from two audits of loanDepot of Irvine, Calif. It determined that down-payment-assistance programs at both companies violated HUD regulations.

Nova and loanDepot each did not respond to a request for comment.

HUD shot back in May 2016.

Then, in July, HUD made what was seen as a conciliatory move, pledging that the agency

The new report, written by Tanya Schulze, regional inspector general for audit in Los Angeles, was issued March 3. Its tough stance suggested that the two parties remain at an impasse.

The borrower-financed down-payment-assistance programs started around 2011 as a way for state housing finance agencies to use Ginnie Mae securities to hedge and fund their programs. U.S. Bank was the issuer of the Ginnie Mae securities cited in the report.

"The programs were the result of agreements among the FHA lender, [the housing finance agencies], and U.S. Bank, essentially creating a prearranged contractual relationship that took unfair advantage of FHA borrowers and the FHA Single Family Mortgage Insurance program," the report said.

U.S. Bank declined to comment for this story.

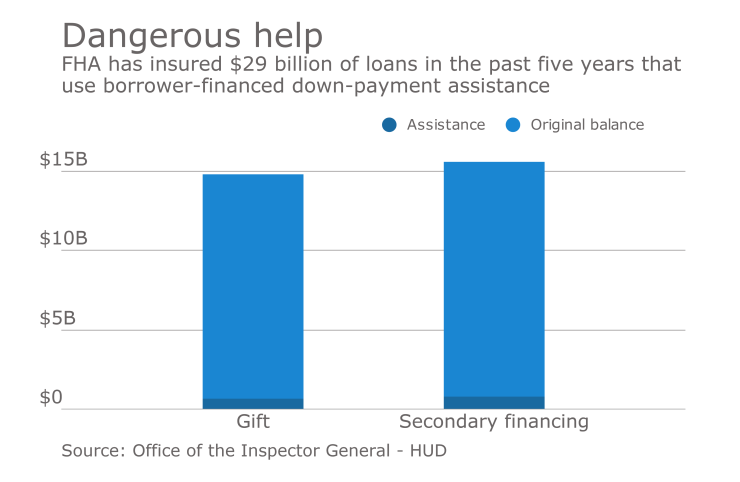

The report’s concerns involved $29 billion of loans, $16 billion of which were originated between the start of 2012 and Sept. 30, 2015, and the remainder originated in the following 12 months.

| Down-payment assistance type | Number of loans | Amount of assistance | Original loan balance |

| 1/1/12 - 9/30/15 | |||

| Gift | 60,824 | $401,344,794 | $8,581,180,616 |

| Secondary financing | 53,358 | $402,948,339 | $7,572,665.787 |

| 10/1/15 - 9/30/16 | |||

| Gift | 32,622 | $230,412,694 | $5,545,364,991 |

| Secondary financing | 46,948 | $409,505.226 | $7,179,890,875 |

| Gift and secondary financing | 1,094 | $167,850,709 | $164,111,508 |

| Total | 194,864 | $1,459,759,899 | $29,046,952,978 |

Source: Office of the Inspector General - HUD

The higher interest rates charged to borrowers allow for better pricing of the securities. Borrowers who receive funding from these programs could not negotiate for a lower rate, and they were unaware they were being charged higher rates, the report said.

These higher costs resembled those in seller-financed assistance programs, where home sale prices were inflated so sellers could recoup the costs.

"The scheme involving [housing finance agencies], lenders and premium interest rates placed the borrower at undue risk of loan failure," which in turn increased the risks to the insurance fund, the report said.

The report was issued on March 3, but HUD's comments were based on a draft written in December, during the Obama administration.

Calling these programs borrower-financed down-payment assistance is misleading, Robert F. Mulderig, acting deputy assistant secretary for single-family housing, wrote in HUD's response that accompanied the report.

The loans had "interest rates only marginally higher than FHA loans without down-payment assistance" because of the slightly increased risk for these borrowers, he wrote.

Furthermore, these programs complied with the National Housing Act, and the way housing finance agencies generate funds to operate their programs is not regulated by FHA, Mulderig wrote.

HUD's response to the report could change under new HUD Secretary Ben Carson, a spokesman for the agency said.

One of the inspector general’s recommendations is to require lenders to obtain a certification that included details about borrowers’ participation in state down-payment-assistance programs.