Co-marketing arrangements between mortgage companies and real estate brokerages have long been a staple of the housing industry. But mounting compliance risks and an evolving landscape for how consumers shop for homes and loans to pay for them has some lenders re-examining their relationships.

Co-marketing has had compliance sensitivities since the Real Estate Settlement Procedures Act took effect in 1974. Recently, those concerns have been magnified by growing scrutiny by the Consumer Financial Protection Bureau.

For example, the CFPB has "requested additional information and documents" as part of a two-year-old review of Zillow's co-marketing program, Chief Financial Officer Kathleen Philips said last month during the company's first-quarter earnings call. Zillow believes its co-marketing program is compliant for all parties involved in it, she said.

The bureau also recently alleged that Prospect Mortgage violated RESPA by, among other things, using a third-party website's ads to pay for referrals. Prospect recently

At the same time, the CFPB has been quite critical of marketing services agreements, which the

Those risks have some lenders completely backing away from co-marketing arrangements.

"Our company does almost no co-marketing with Realtors, and the reason for it is our company has taken a very strong compliance stance," said Darryl Crawford, a regional manager at Sente Mortgage in Austin, Texas.

A local, established lender like Sente might be able to market to the purchase market sufficiently with a website of its own and traditional forms of co-marketing with Realtors like homebuyer seminars, he said.

Co-marketing might be more essential to other lenders, though.

"I would tell you that the newer the mortgage banker, or the newer the mortgage company, the more important their online presence is," said Crawford.

With consumers increasingly starting their home and mortgage shopping online, some lenders may also find they can sufficiently achieve their online advertising goals on their own. Zillow, for example, offers both a co-marketing advertising platform and a standalone product where lenders can advertise their rates.

RESPA prohibits lenders and real estate firms from paying or receiving fees, kickbacks or any other "thing of value" in exchange for referral business. In the context of joint advertising, each side must pay their fair share. Divvying up those costs was somewhat easier in the past, when print advertising was the primary method of reaching consumers.

While digital advertising tools like Zillow's and other co-marketing platforms are better are engaging consumers and tracking results, they also create new challenges for distributing costs equitably.

As in traditional print ads, online co-marketing has a better chance of passing compliance tests if the presentation of the two parties involved and the split in costs are equitable, making it less likely to be seen as a paid referral.

In addition, the interactive nature of a click-through on a website has added another dimension to online co-marketing compliance reviews, said Richard Horn, a former CFPB attorney who is now in private practice.

Compliance "really depends on how [the website's] set up, in addition to the language used in the advertisements," said Horn, who has not worked on either the Zillow investigation or the Prospect consent order.

Despite the compliance risk, marketing on Zillow is something large or growing lenders may find it tough to compete without, said Garth Graham, a senior partner at mortgage industry consultancy Stratmor Group.

"Zillow is significant as a percent of the overall search traffic related to real estate especially in a purchase market," he said. "Over 50% of all real estate searches are done on Zillow, so lenders need to have a strategy around how to have a presence on Zillow."

However, paid co-marketing isn't the only way for lenders to do that.

"We do have a solution for lenders to publicize testimonials. That will help drive a presence on Zillow as well as drive traffic to their sites, and that is not getting into the lead business or joint marketing business," said Graham. "One of the things that we recommend for clients is that they actively pursue getting testimonials from satisfied consumers on Zillow."

But co-marketing with a real estate agent can add more value, he added.

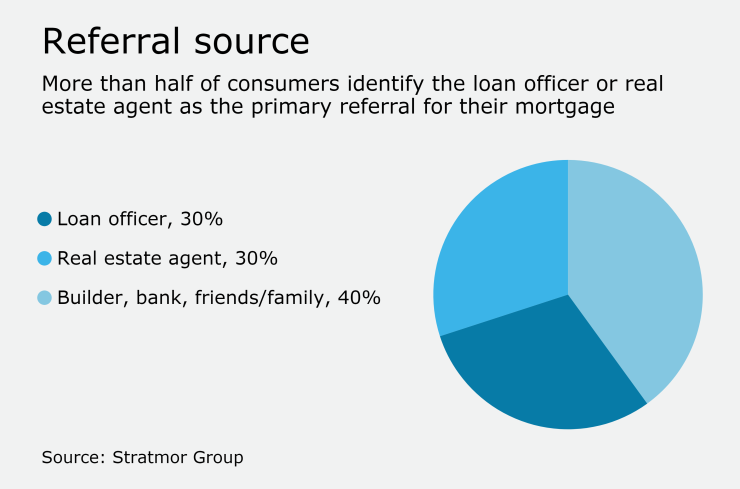

While borrowers identify loan officers as the primary referral for their home loans 30% of the time, real estate agents represent another 30% of all referrals in purchase transactions; and third-party or in-house experts can help with compliance.

That being said, different regulators have had different takes on industry rules like RESPA and that can make what passes muster tough to anticipate.

"The inconsistent interpretation of these regulations gets very problematic," Graham said.