A reduction in Ditech Holdings' quarterly net loss fell short of what the company needed to avoid the possibility of another Chapter 11 filing.

Ditech has "begun to have discussions with certain of its corporate debt holders and their advisors regarding potential strategic transactions that may involve implementation through an in-court supervised Chapter 11 process," according to a company press release.

Although Ditech cut its net loss by 70%

The company had

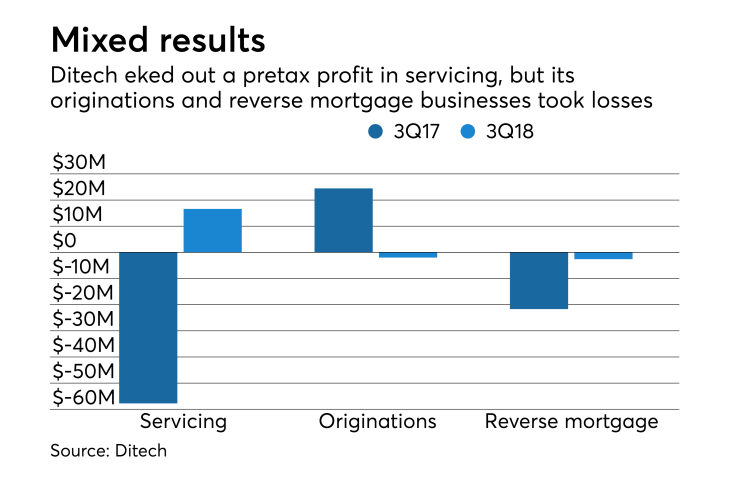

While cost-cutting and other strategic changes by and large improved Ditech's servicing results during the third quarter, its origination business took a net loss. A relative rise in mortgage rates in the past year has generally improved returns from servicing operations while hurting origination results market-wide.

Ditech's pretax servicing income rose to more than $16 million in the third quarter, compared to a loss of more than $57 million a year ago. The originations business line took an almost $2 million pretax loss, compared to more than $24 million in pretax income during the third quarter of 2017.

The company's reverse mortgage business continued to operate at a loss, albeit a significantly reduced one. Its pretax loss for that business line was more than $2.6 billion, compared to a loss of more than $21 million a year ago.

Ditech was