Despite digital mortgage advances, borrowers think it still takes too long to get a loan, J.D. Power finds in its annual customer satisfaction ranking of originators.

The most frequently used method for submitting a mortgage application for both refinances and purchases was online for the first time, according to the survey. Forty-three percent applied digitally, up from 28% a year ago.

But satisfaction with online submissions declined 8 points and borrowers also gave online submission a satisfaction score 10 points below that of in-person applications.

"We're at a critical inflection point in the mortgage industry where new technology and the growing use of digital mortgage application channels has made it possible for the origination process to move more quickly; however, the customer is still the final judge of speed and quality," Craig Martin, director of the mortgage practice at J.D. Power, said in a press release.

"A critical element of satisfaction is setting expectations, and this tends to be a weakness of technology, which is demonstrated by substantially lower satisfaction among customers who do not work with a human to complete their application," he added.

Ninety percent of customers at the online lender Quicken Loans, which J.D. Power ranked No. 1 for the eighth year in a row, gave the company high marks for providing status updates throughout the origination process.

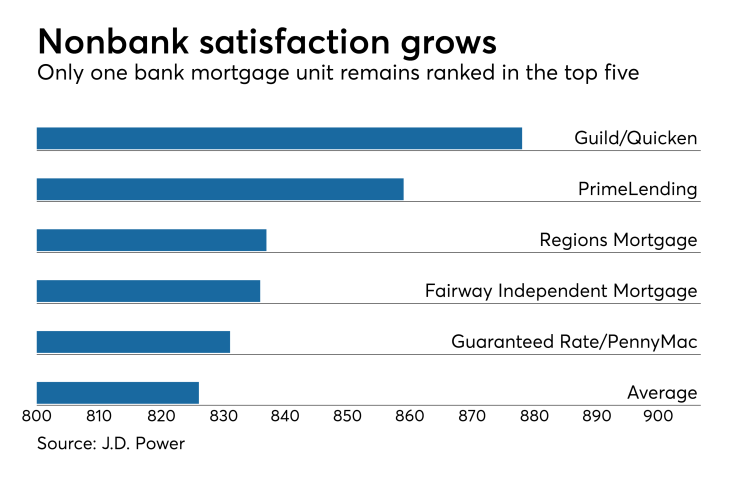

But for the first time in years Quicken Loans had competition from another nonbank, Guild Mortgage. Both tied at No. 1 with customer satisfaction scores of 878 on a 1,000-point scale.

Average satisfaction with mortgage originators was down eight points this year from 834 last year, driven in part by longer closing times due to a purchase process that customers found took almost a week longer than the previous year at 36 days.

Purchase transactions, which take longer than refinances to complete, were more prevalent in the market in 2017.

Nonbanks occupied all but one of the top five slots this year, as opposed to three last year.

PrimeLending ranked at No. 2 with a score of 859, Regions Bank's mortgage unit ranked No. 3 with a score of 837, Fairway Independent Mortgage ranked No. 4 with a score of 836, and Guaranteed Rate and PennyMac were tied for fifth with scores of 831.

Guild, PrimeLending, Regions, Fairway and PennyMac were not named in the survey last year. Guaranteed Rate ranked No. 4 in 2016 with a slightly higher score of 843.

Chase Bank, which ranked fifth last year with a score of 835, dropped to No. 12 this year with a score of 811.

Citibank's mortgage unit, which was No. 2 in 2016 with a score of 851, and Ditech, which was ranked No. 3 last year with a score of 849, shared the No. 15 slot this year. Both received satisfaction scores of 806 for 2017.