The growth of digital mortgage origination channels has improved customer satisfaction with the process, but consumers still want personal interaction at some point, according to J.D. Power.

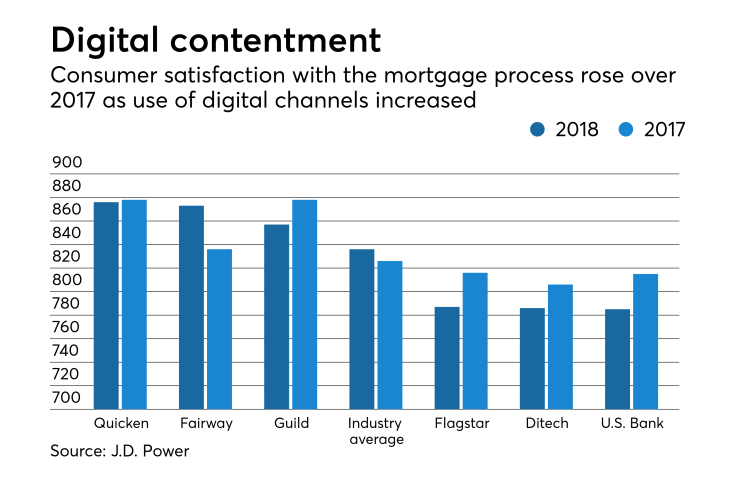

The industry average score of 836 in the 2018 Primary Mortgage Origination Satisfaction Survey was an increase of 10 points

"While improved digital offerings are helping mortgage originators

During the process, a borrower uses an average of 3.1 different communication channels, with phone (72%), website (69%) and email (58%) as the most common methods.

But only 3% of borrowers relied exclusively on a digital self-service channel when applying for a loan.

Borrowers who only communicated with their lender over the phone or in person gave the process an 871 overall satisfaction score, with those that use a mix between digital and in person gave an 868 average score.

The digital self-service borrowers gave that process an 823 score, J.D. Power said.

Representatives add the greatest value in making follow-up contact after an initial inquiry and when confirming loan terms and payment, the J.D. Power press release said.

Speed of that follow-up contact is reflected in the satisfaction score. Consumers that heard back from the originator within one day gave an average 869 score, but that fell to 852 if took between two and five days and 806 for six or more days.

Quicken Loans, for the ninth consecutive year, had the highest score on the survey, at 876, but this was down two points from last year. Guild Mortgage, which tied Quicken last year, had a score of 857, down 21 points.

Fairway Independent Mortgage moved into second place this year, up 37 points from last year, to 873.

USAA and Navy Federal Credit Union had scores of 891 and 888, respectively, but do not qualify to be ranked because they only work with selected consumers and not the general population.

Mr. Cooper, which last year was tied for the lowest score, moved up to 13th out of the 21 companies ranked, with a score of 823; that was an improvement of 41 points.

The three lenders with the lowest scores were Flagstar at 787, down 29 points, Ditech, at 786, down 20 points, and U.S. Bank Home Mortgage, at 785, down 30 points.