The nationwide mortgage

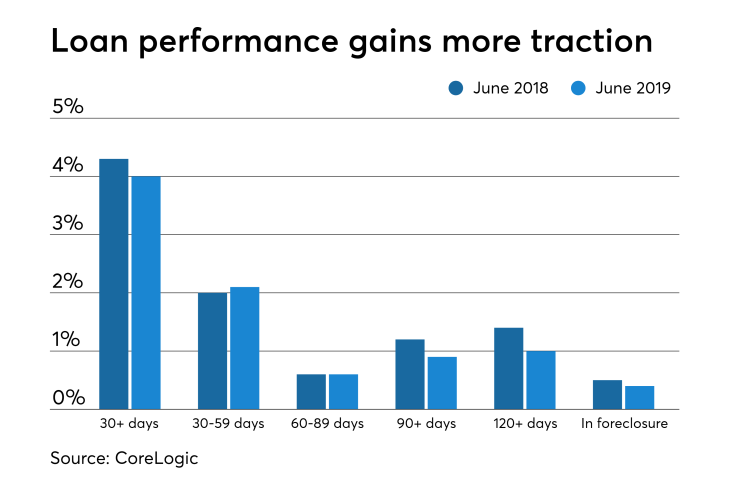

CoreLogic's Loan Performance Insights Report showed 4% of mortgages were in some stage of delinquency in June, down from 4.3% the year before while rising

"A strong economy and eight-plus years of home price growth have made

However, warning signs arose with eight individual states that had annual increases in delinquencies.

"We saw rates jump in states such as Vermont, New Hampshire, Nebraska and Minnesota that weren't

The increases without direct effects from hurricane or wildfire damage give possible warning that a future shift could be coming. For now, the foreclosure inventory rate remained at the 20-year low of 0.4%, inching below June 2018's 0.5%. The serious delinquency rate of loans 90 days or more past due including foreclosures also fell, going to 1.3% from 1.7%.

Vermont had the largest growth, going up by 0.7%, then New Hampshire at 0.3%, followed by Nebraska and Minnesota at 0.2%, and Connecticut, Iowa, Michigan and Wisconsin at 0.1% each.

Early-stage delinquencies, on the other hand, edged up annually to 2% from 2.1% while the share of mortgages 60-89 days past due stayed static at 0.6%.