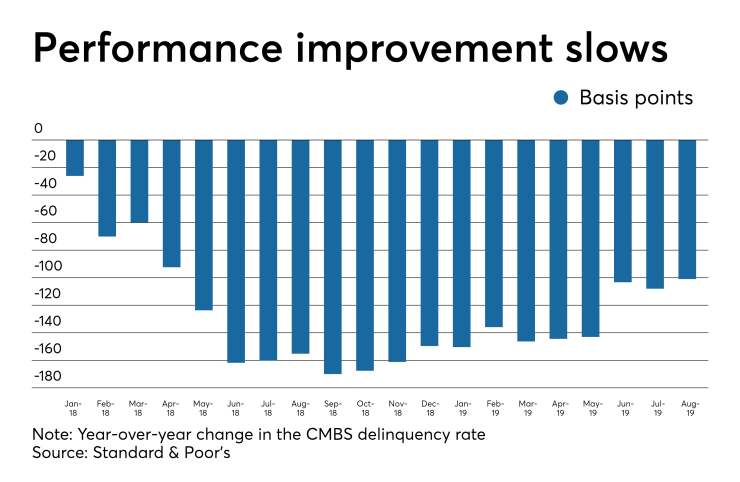

While delinquent loans in commercial mortgage-backed securities continued trending downward, there was an uptick in more recent originations, a

August's total

But while the delinquency rate in remaining precrisis CMBS vintages fell 98 bps to 33.1%, contributing to an overall decline, the larger pool of

S&P also looked at the 12-month rolling average of post-crisis CMBS 2.0 delinquencies by year of origination.

For the 2011, 2014 and 2016 vintages, S&P found the delinquency rates were trending upwards, while for the other years between 2010 and 2018, they were stable.

There was one vintage, 2014, where the 12-month rolling average in August was over 1%.

While CMBS loans secured by retail properties still have the highest delinquency rate, at 3.48%, the rate was down 31 bps from July, 130 bps from August 2018 and 258 bps from the peak in September 2017.

The only other property type where the delinquency rate declined from July was lodging, which fell 24 bps to 1.21%.

Lodging displaced multifamily as the property type with the lowest delinquency rate.

Multifamily loans had a 1.38% delinquency rate, up 29 bps from July and 14 bps from last August.

The rise in the multifamily delinquency rate comes amid forecasts suggesting there will be

By share, retail made up 41.8% of August's CMBS delinquencies, down from 4.26% the prior year.