Fannie Mae and Freddie Mac have signed a settlement with New York Attorney General Andrew Cuomo to implement new appraisal standards starting Jan. 1, 2009, that will bar lenders selling loans to the mortgage giants from using in-house appraisers or subsidiary appraisal firms. On brokered loans, lenders must certify in representations and warranties that the mortgage broker did not select the appraiser. Fannie and Freddie control over 60% of the mortgage market, and Mr. Cuomo said the settlement will transform appraisal practices by state and federally regulated banks that had pressured appraisers to inflate appraisals. "Now national banks have a clear choice: immediately adopt the new code and clean up fraud in the mortgage industry or stop doing business with Fannie Mae and Freddie Mac," Mr. Cuomo said. As the regulator of the government-sponsored enterprises, the Office of Federal Housing Enterprise Oversight also signed the settlement. "For the banking regulators, this is kind of tough to swallow because the practices that they had permitted are prohibited by this agreement," mortgage banking consultant Howard Glaser said.

-

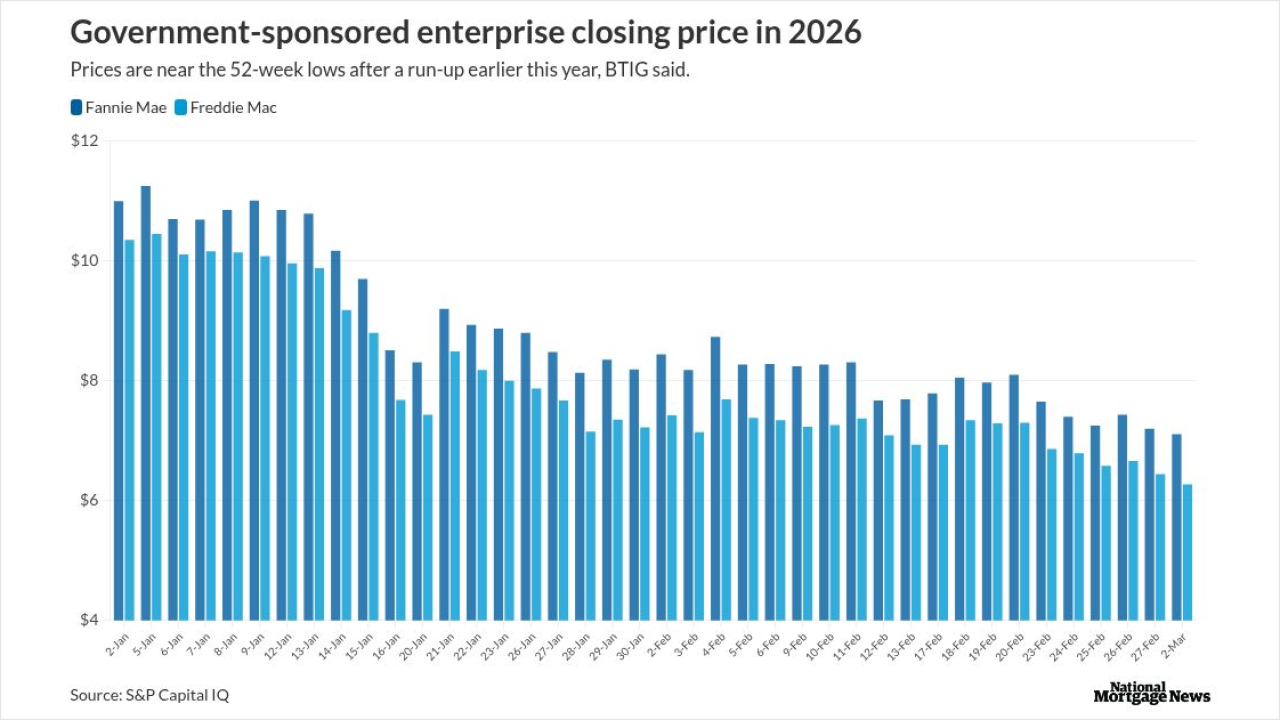

The Supreme Court's decision seems to set limits on Pres. Trump's power, even if he wasn't inclined to hold on to the GSEs to control mortgage rates, BTIG said.

2h ago -

An appellate court denied the bank's argument targeting the state's Foreclosure Abuse Prevention Act and ordered it to pay the defendant's legal fees.

5h ago -

This year 40 companies had what it takes to land on the Best Mortgage Companies to Work For list.

March 2 -

Markets were bracing for the chaos of a regional war; banks may be the target of sophisticated cyberattacks, experts warn.

March 1 -

MBS numbers at both soared in January, when Trump directed the enterprises to accumulate more bonds, but a decline in loans shrunk Freddie's total number.

February 27 -

New York is seeking $21 billion in federal grants for a construction project at Sunnyside Yard, which would allow the city to build 12,000 new affordable homes.

February 27