Mortgage lending credit standards loosened a bit last month as investors displayed more interest in non-qualified mortgage and nonagency jumbo loans to stay competitive, according to the Mortgage Bankers Association.

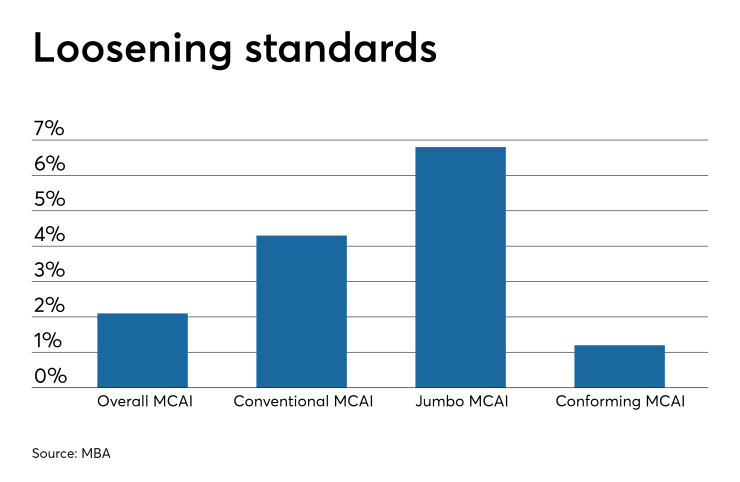

Mortgage credit availability, which is driven by trends in jumbo lending, rose 2.1% in April to a reading of 186, according to the MBA's Mortgage Credit Availability Index. A decline in the MCAI represents a tightening of standards and an increase suggests credit is loosening; the index was benchmarked at 100 in March 2012.

"Investors continued

Signs of a weaker purchase market were evident in the

The MCAI component measuring conventional mortgages grew 4.3%, while the government MCAI remained unchanged. The jumbo MCAI jumped 6.8% to its highest recorded level since this data began being tracked in 2011. The MCAI for conforming loans increased 1.2%.

The MCAIs by loan type use the same principles to determine the overall MCAI, and help identify trends of the respective segments.