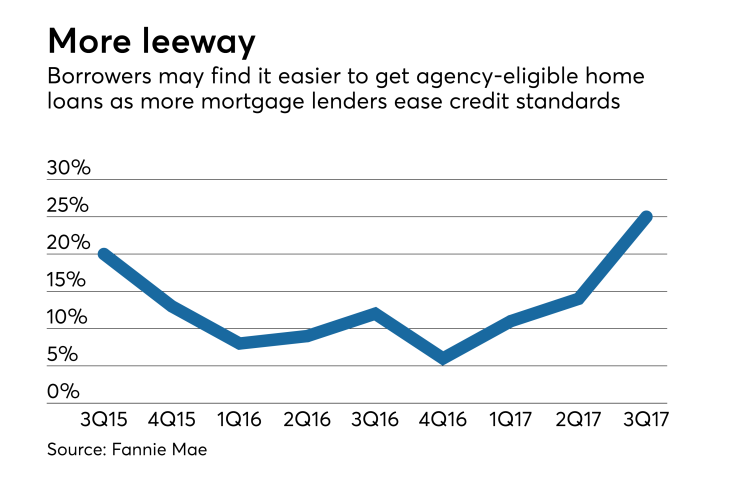

The share of lenders easing credit for government-sponsored enterprise-eligible loans is at a high not seen since Fannie Mae started a survey to track it.

At least a quarter of all lenders eased GSE credit in the past quarter and almost 20% plan to continue to do so in the next three months, according to Fannie's third-quarter mortgage lender sentiment survey. Credit for government loans and nonagency loans also is easing.

"Lenders further eased home mortgage credit standards during the third quarter,

"In particular, both the net share of lenders reporting easing on GSE-eligible loans for the prior three months and the share expecting to ease standards on those loans over the next three months increased to survey highs," Duncan said.

"Lenders' comments suggest that competitive pressure and more favorable guidelines for GSE loans have helped to bring about more easing of underwriting standards for those loans," he added.

Nearly three-fourths of lenders cited competition as the primary driver of decreased profit margins, a marked change from two years ago when 61% of lenders identified compliance as the key driver.

More than one-third of lenders in the third quarter identified reduced consumer demand as the primary driver of thinner margins. Only 19% identified compliance as the main concern.

Staff expenditures were the key driver of thinner profit margins for 17% of lenders, and 13% identified spending on operations and technology as the biggest concern.