Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

The combined debt outstanding was $3.66 trillion, and was 2.1% higher on Dec. 31, 2019 than at the end of the third quarter and 7.3% higher than it

"In 2019, the amount of mortgage debt backed by commercial and multifamily properties grew by the largest annual amount since before the global financial crisis," Jamie Woodwell, the MBA's vice president of commercial real estate research, said in a press release. "Every major capital source increased their holdings, and some by double digits. Continuing the recent trend, the growth in multifamily mortgage debt outpaced that of other property types.

"Looking ahead, a key question will be how the

Preliminary data indicated that 2019

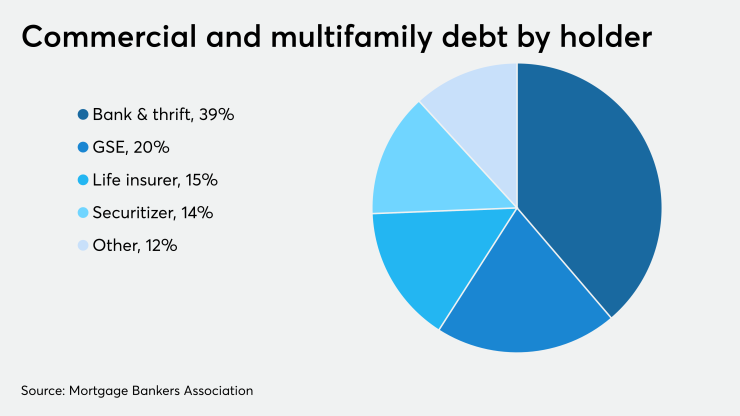

At the end of last year, banks and thrifts held the largest share of commercial/multifamily mortgages at $1.4 trillion, or 39%. Next was the combination of agency and government-sponsored enterprise portfolio and mortgage-backed security holdings at $744 billion (20%). Life insurance companies held $561 billion (15%), and commercial mortgage-backed security, commercial debt obligation and other asset-backed issuers made up $504 billion or 14% of the total outstanding. All four groups had year-over-year increases in their holdings.

But when it came to multifamily mortgages alone, the agency/GSE combination held the largest share of total debt outstanding at $744 billion (49%), followed by commercial banks with $459 billion (30%), life insurers with $149 billion (10%) and state and local governments with $88 billion (6%). Securitizers had a 3% share at year-end 2019.