On the heels of CoreLogic's earnings report, which shows record full year and fourth quarter revenues, CoStar Group added a cash component to its hostile counterbid for the company, in an effort to wrest it away from Stone Point Capital and Insight Partners.

CoStar is now willing to pay $6 per share in addition to

"The merger agreement remains in full force and effect, and the board of directors of CoreLogic has not withdrawn or modified its recommendation that the stockholders of CoreLogic vote in favor of the approval of the merger, the merger agreement and the transactions contemplated thereby," the Irvine, Calif.-based data provider and appraisal management company said in a statement.

"CoreLogic's board of directors, consistent with its fiduciary duties and the terms of the merger agreement, will carefully review the proposal in consultation with its outside legal counsel and financial advisors," the statement said.

The new bid is valued at approximately $90 per share based on its Feb. 26, closing price and approximately $97 per share based on the latest 30-day volume-weighted average share price, CoStar claimed in a letter to CoreLogic's board.

CoreLogic chose an

A request for comment from Stone Point and Insight was not returned by press time.

The cash component boosted the aggregate value of CoStar's bid by $425 million to $7.25 billion. "We expect the CoreLogic board to deem this proposal to be a 'Superior Proposal' within 48 hours," the March 1 letter signed by CoStar CEO Andrew Florance said.

Furthermore, to alleviate any antitrust and regulatory concerns on CoreLogic's part, CoStar is now proposing a six-month deadline for the deal, equal to that in the agreement with Stone Point/Insight. It also agreed to advance CoreLogic the $165 million termination fee.

"We are confident that after consultation with your outside legal counsel and financial advisors and considering all legal, regulatory and financing aspects that you deem appropriate, that our revised proposal described herein is more favorable, from a financial point of view, to CoreLogic's stockholders than the transactions contemplated by the [Stone Point/Insight] Agreement," Florance said.

Between the news of the higher bid and the earnings release, CoreLogic's stock opened on Monday morning at $85.44 per share, up from its previous close of $84.66. By 11:45 a.m. on Monday it was up to $86.54 per share.

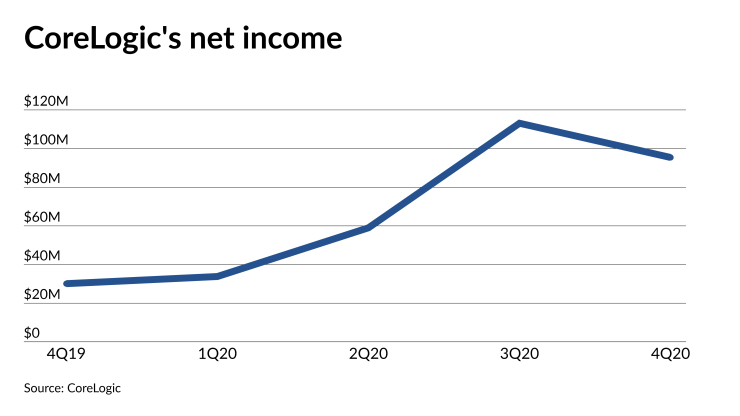

CoreLogic had a fourth quarter 2020 net income of $95.4 million, compared with $113.1 million in the third quarter and $30.1 million in the

But its operating revenue grew to $467.6 million from

The growth in fourth quarter revenue was attributed to organic year-over-year growth of 7% in the property intelligence and risk management segment, specifically from double-digit gains in property insights along with new international business. Revenues grew 51% in underwriting and workflow solutions due to strong market volumes. It outperformed the market in three lines of business: tax and flood zone solutions, credit solutions and valuations, the company said.