The transformation into an appraisal management company paid off for CoreLogic, which reported its best first-quarter results ever, President and CEO Frank Martell said on the company's earnings call this week.

Net income reached $33.8 million for the first quarter, compared with

CoreLogic's revenue year-over-year increased by $26 million, or 6%, to $444 million in the first quarter.

However,

The company announced

"Our core mortgage operations continued to gain scale and build market leadership through the provision of bundled solution packages that leverage our efficient and integrated technology and back-office infrastructure and best in the industry data repositories," Martell said on the call. "Over the past several quarters, we've been gaining significant numbers of new clients seeking strategic, innovative and reliable partners for their critical underwriting processes."

For the second quarter, CoreLogic expects revenue in the range of $420 million to $445 million, which takes into account the impact of the coronavirus on its business, in the range of $15 million to $20 million. It is also expecting

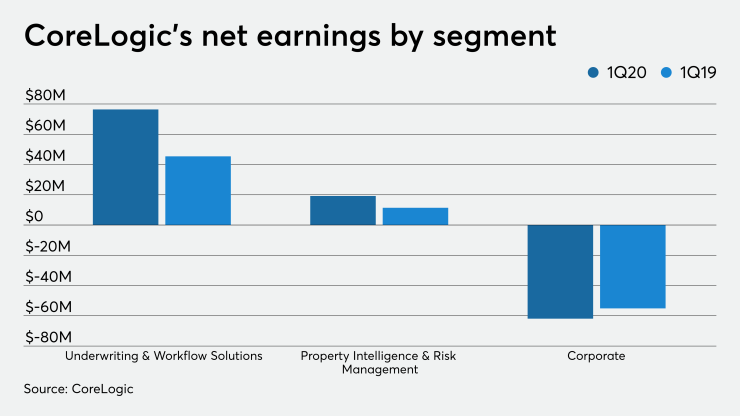

CoreLogic's Underwriting & Workflow Solutions division, where the AMC business is housed, had first-quarter net income of $76.4 million, up from $45.4 million one year prior.

UWS revenue increased 13%, "driven by higher mortgage unit volumes and organic growth fueled by market share gains in the areas of flood, property tax solutions and valuation platforms," said Jim Balas, chief financial officer.

The other operating segment, Property Intelligence & Risk Management Solutions, earned $19.2 million in the first quarter, versus $11.4 million for the same period last year.

Its corporate reporting segment had a loss of $61.9 million, compared with a loss of $55.1 million in the first quarter of 2019.

But Martell struck an optimistic tone, anticipating growth and touting the company's AI-driven tools, automation and analytics, which he expects will become "much more prominent" once "COVID has settled down."

"We've got a lot in the hopper and I think our momentum in the first quarter is somewhat reflective of that, that momentum that we had coming out of last year," he said.