CoreLogic is exiting its loan origination software and default management operations over the next 24 months and instead accelerated plans to transform its appraisal management company unit.

Those two noncore businesses generated approximately $40 million in revenue in the first three quarters of the year, the company said in a press release.

The appraisal management business had $65 million in revenue over the same period. However, this change will result in lower revenue for CoreLogic during 2019.

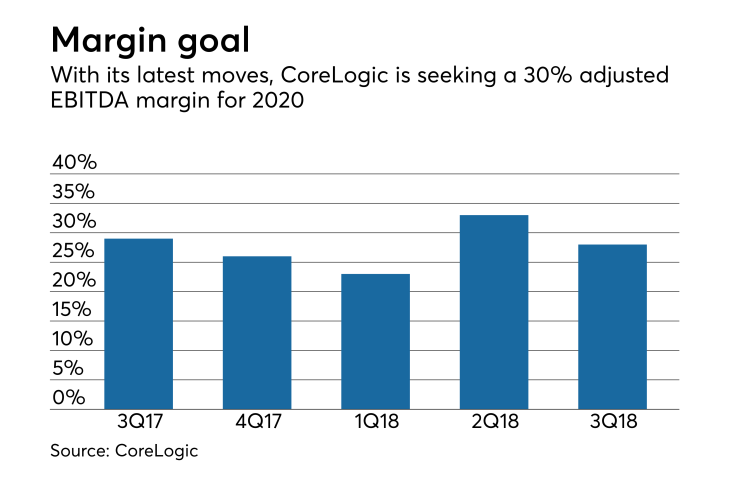

"CoreLogic remains focused on capitalizing on our scale and market leadership and the opportunities presented by our must-have workflow solutions in the U.S. mortgage market," President and CEO Frank Martell said in a press release. "The actions we are announcing today should further position the company to achieve its 30% [adjusted EBITDA] margin target and enhanced organic growth rates in 2020."

CoreLogic's adjusted EBITDA was $128 million in the third quarter, down 7% from the year prior, driven by reduced U.S. mortgage loan unit volumes and lower appraisal revenue, among other things, the company's third-quarter earnings release said. The adjusted EBITDA margin for the quarter was 28%; for the same period in 2017 it was 29%.

When the LOS first came to market, many considered Dorado's cloud computing, automation and highly custom capabilities ahead of their time in the mortgage industry. But those cutting-edge features often required lengthy and costly implementations that were out of reach to all but the largest lenders, like JPMorgan Chase.

But the larger and more sophisticated institutions that could actually benefit from Dorado's advanced features were often wary of doing business with a small startup like Dorado. CoreLogic's

Dallas-based PrimeLending was one of the few lenders still using Dorado, but recently announced plans

CoreLogic's more recent deals have been focused on the appraisal business. The company acquired