CoreLogic has asked CoStar Group to include more cash in its

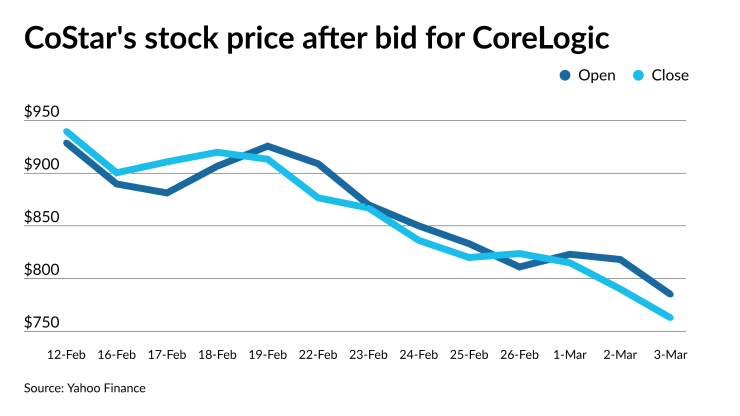

"We appreciate your inclusion of cash consideration that, as we expressed in our prior letter and had discussed with you previously, helps to provide greater certainty of value," Frank Martell, CoreLogic's president and CEO said in a letter the company made public. "However, $6 per share in cash does not meaningfully reduce CoreLogic shareholders' exposure to the concerning volatility of your stock."

CoStar did not respond to a request for comment.

On Feb. 12, before CoStar made its

CoStar is offering 0.1019 shares of its common stock for each share of CoreLogic in addition to $6 per share in cash. The deal with Stone Point and Insight is valued at $6 billion; it calls for

The other issue raised by CoreLogic involves the deal's termination date. While CoStar’s revised offer included a termination date similar to the one in the Stone Point/Insight agreement, it can be unilaterally extended by CoStar for one year.

According to the CoreLogic letter, CoStar asked for the ability to extend the date due to possible negotiations or litigation with the government involving antitrust approval for the deal. That is contrary to previous public statements by CoStar involving antitrust matters, the letter said.

"We observe that the time value of money at any reasonable cost of capital and assumed period of incremental time to transaction close impacts the present value of your updated proposal. For these reasons, we invite you to reconsider your position," Martell said. "Any new proposal should deliver increased, more certain value and as much cash consideration as possible."

CoreLogic is sending CoStar a revised merger agreement "reflecting important, limited clarifications" to the latest proposal, the letter said.