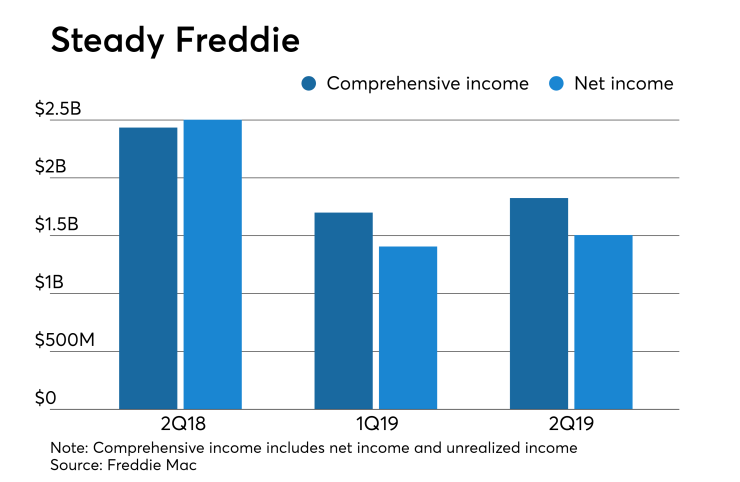

If 2018's second-quarter

However, David Brickman, Freddie Mac's new CEO, sees the stable revenue as a position of strength. On his inaugural earnings call as CEO, Brickman touted the "continuity and consistency" with the GSE's growing track record of returns and steady business.

While this past quarter failed to match the year-ago profit levels, it stepped up from

"Obviously it depends on the magnitude and nature of any recession, but we are extremely well positioned to withstand stress," Brickman said in an interview. "The increasing amount of credit risk transfers we have undertaken — both in the single-family and multifamily businesses — position us well against that type of stress and will insulate us against losses.

"The quality of the business we have on the books as well as the nature of the risk management framework culture we've got really positions us well to be responsive if we do see changing economic conditions."

The government-sponsored enterprise reduced its conservatorship capital by $6 billion year-over-year through credit risk transfer activity, legacy asset dispositions and home price appreciation. "We are less and less exposed broadly to macro credit risk with every passing year," Brickman said on the call. Freddie's return on conservatorship capital went to 14.1%, down annually from 16.9%, but up from last quarter's 12.7%. ROCC is an important metric Freddie measures its status by.

Increased purchases of loans made to first-time homebuyers also helped revenue. First-time homebuyers represented 48% of new single-family purchase loans in the second quarter, up from a share of 46.3% across 2018 and 35% in 2008. The GSE funded about 702,000 single-family homes through the first half of 2019.

Freddie Mac remains committed to its three priorities of tackling housing affordability beyond credit, leveraging its position as a housing leader and preparing for the conservatorship's potential end.

The largest challenge for Freddie's nascent CEO is "adapting to a lot of change broadly in the environment," Brickman said. "We have change in terms of a new FHA director, we've even had turnover at our board of directors with a new chair in December. All positive, but I'm adapting and looking forward to what the future might bring."