The consumer outlook for mortgage rates is really the only thing

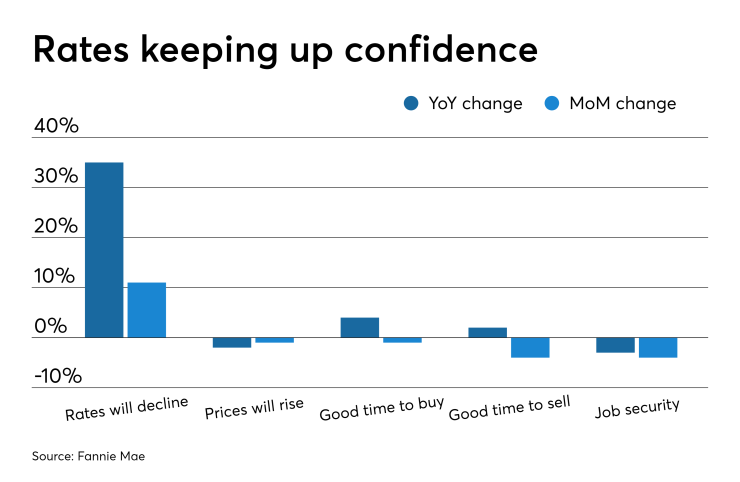

Despite most components of Fannie Mae's HPSI holding steady or declining, consumers' belief that rates will decline shot up 35% in August from a year ago, pushing up the overall index 0.1 points to a new peak of 93.8. Favorable rate expectations also suggest refinance activity should stay hot.

"Growing expectations that mortgage rates will remain flat or decline are reflected in the HPSI's latest reading, which is now at a survey high even though other indicators of economic and housing market sentiment are flat to negative," said Doug Duncan, senior vice president and chief economist.

"Unfortunately, much of the lower interest rate environment can be attributed to global economic uncertainties, which appear to have dampened consumer sentiment regarding the direction of the economy. We do expect housing market activity to remain relatively stable, and the favorable rate environment should continue supporting increased refinance activity."

More Americans claim it’s a good time to sell a house than those saying it's an optimal time to buy one. About 40% of consumers in August cited it's a good time to sell, which is up 2 percentage points from last year. Those saying it's a good time for a home purchase rose 4 percentage points over the same period, but to a lesser overall share of 25%.

The share of Americans expecting home prices to grow over the next 12 months declined 2 percentage points from a year ago to 36%.

Consumers were also a little less secure with their employment in August. The share of consumers confident in not losing their job over the next 12 months declined 3 percentage points from last year and 4 from the previous month, while those reporting their household income is significantly higher than a year ago ticked down a percentage point.