Fewer and fewer consumers found May’s home purchase conditions palatable given

After the segment of borrowers who thought it was a good time to buy dropped to a Fannie Mae Home Purchase Sentiment Index

Although consumers have clear awareness of the

“Consumers do appear more intent to purchase on their next move, a preference that may be supported by the expectation of continued low mortgage rates as well as the elevated savings rate during the pandemic, which may have allowed many to

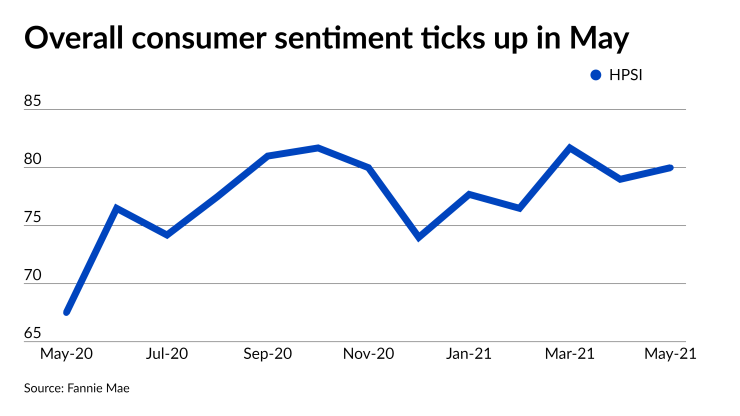

Despite the major dropoff in those optimistic about buying a home, four of the index’s six components exhibited positive movements month-over-month, raising the overall home purchase sentiment score to 80 from 79 in April and 67.5 year-over-year.

Two-thirds of consumers said it was a good time to sell compared to 25% who said it wasn’t. The net positive 42% increased from 41% in April and from -30% in May 2020. As the economy keeps building momentum out of the pandemic’s recession, perspectives on employment and salary showed the most improvement. A 75% net share of respondents weren’t concerned about losing their jobs, up 11 percentage points monthly and 24 percentage points annually. Meanwhile a net 16% reported significantly higher household income in the past 12 months, up 12 points and 17 points from the month and year before, respectively.

A net 43%