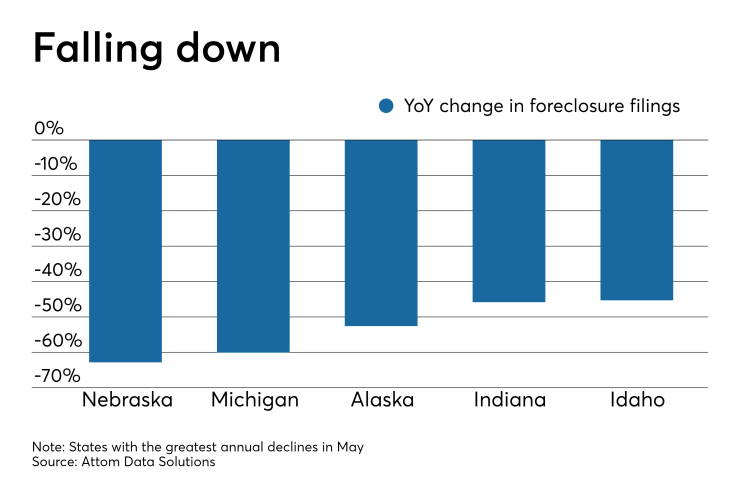

Completed foreclosures shot down 50% in May from the year before, with overall activity also declining by 22% during the same period, according to Attom Data Solutions.

Mortgage lenders completed foreclosures on 10,634 properties, also down 4% from

The news falls in line with

"We are continuing to see a downward trend with overall foreclosure activity, especially in completed foreclosures, declining year-after-year. However, in May 2019 we did see an uptick in the number of states increasing in foreclosure starts going from 17 to 23 states rising annually, and again Florida is bucking the national trend with a continuous annual increase," Todd Teta, Attom's chief product officer, said in a press release.

Still, foreclosure starts overall were down 9% from May of last year, and Florida's figures — relative to the past — are not substantial despite their growth, according to Bruce Norris, president of real estate investment company The Norris Group.

"To put the numbers in perspective, I would use a full year, perhaps 2006 as a 'normal' benchmark number. That would be the last year before the real estate world crashed," said Norris. "The total foreclosure starts for Florida in 2006 was 102,875. In 2018, there were 33,031 foreclosure starts. Even at a 25% increase over 2018, 2019 will still be less than 50% of 2006. An increase of some 8,000 foreclosure starts is not a game changer at this point."

Florida foreclosure starts increased 23% year-over-year in May. Comparatively, Texas and Pennsylvania saw starts plummet 39% and 38%, respectively.