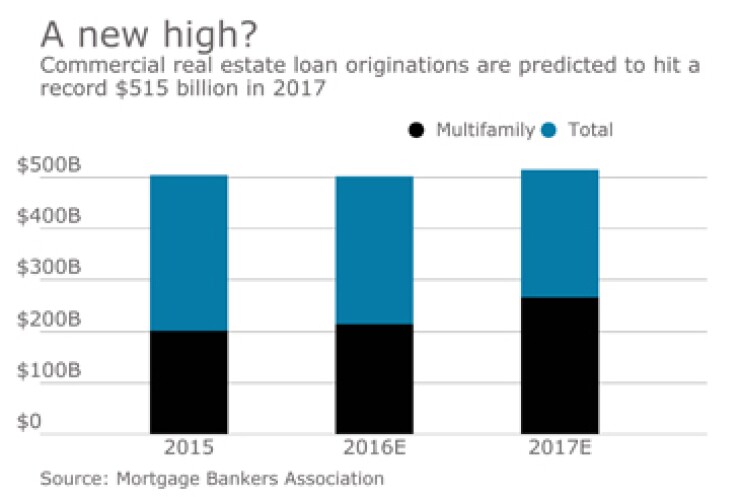

Commercial mortgage loan originations in 2017 are expected to increase 3% over last year to a record high, as market fundamentals and property prices remain strong, according to the Mortgage Bankers Association.

It projects total volume of $515 billion, with multifamily lending making up $267 billion. For 2016, the MBA estimated that there was $502 billion of commercial real estate loans originated, down from

The current record year for CRE volume is $508 billion, set in 2007.

"Nationally, commercial real estate fundamentals and prices remain strong. That overall strength is expected to continue to support active sales and mortgage markets.

"Rising interest rates are likely to take a bit of wind out of the market, but even so, modest increases in originations should bring 2017 to record levels of borrowing and lending for commercial, and particularly multifamily, properties," Jamie Woodwell, MBA's vice president of commercial real estate research, said in a press release issued Monday.

By investor type, loans originated last year to support commercial mortgage-backed securities fell 15% compared with 2015, originations for life insurance companies were flat, commercial bank portfolio originations were up 6% and there was a 10% increase in loans originated for Fannie Mae and Freddie Mac.

Fannie Mae had $55.3 billion of multifamily loans originated through its Delegated Underwriting and Servicing program in 2016, which is the most that program has ever done, it said in a separate press release. It also issued $54.9 billion of CMBS in 2016.

Freddie Mac also set a record, with $56.8 billion of multifamily mortgages originated in 2016, it said in its own press release.

In the fourth quarter, there was a 7% year-over-year decline in CRE loan volume as there was a decrease in originations for hotel, health care and retail properties, the MBA said.