A new affordable housing coalition is calling for the regulator overseeing government-sponsored enterprises Fannie Mae and Freddie Mac to put planned underserved markets goals on hold until they can be reworked.

The

“We respectfully urge the Federal Housing Finance Agency to pause the effective date of the plans while requesting substantially improved written proposals from the enterprises,” the letter from the coalition said.

The letter also identifies three broader policy development challenges of concern at the GSEs:

As for the proposed duty to serve goals themselves, the coalition protests lower targets set for all three duty to serve categories — manufactured housing, affordable housing preservation and rural housing — and what the coalition describes as a contraction in some efforts.

“They inappropriately propose to drop highly touted and much needed programs such as purchasing

In their proposed DTS goals, Freddie had noted that it had suspended a pilot for these loans for “safety and soundness considerations,” while Fannie had said, “We continue to work with our regulator to understand safety and soundness considerations and the viability of a chattel loan program.”

Although price points for the homes involved are low, high financing costs have been a hurdle for buyers. AH advocates would like to see if GSE purchases and securitizations could be used to reduce interest rates for these loans.

“I think a lot of people, including at least some who work at the enterprises, see manufactured housing in general and chattel in particular as one of the biggest untapped markets,” said Jim Gray, a senior fellow at the Lincoln Institute of Land Policy, one of the groups that signed the letter. “There is a way to safely do this type of lending.”

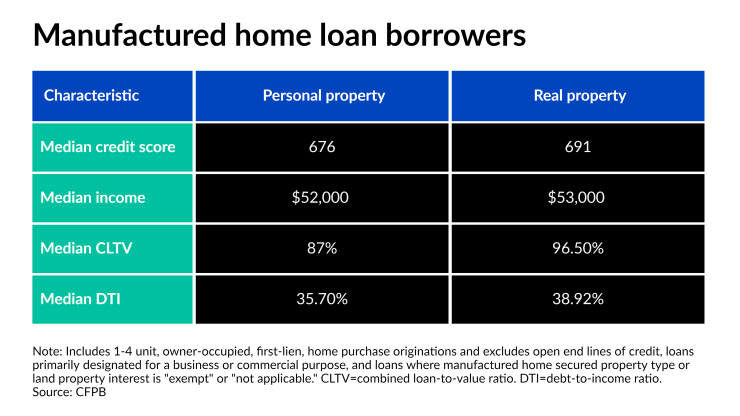

The credit profile of borrowers who obtain manufactured home loans titled as personal property is similar to those with financing secured by real estate, according to a Consumer Financial Protection Bureau report earlier this year.

In addition to the Lincoln Institute, other signatories to the letter include: the Center for Community Progress, cdcb, Enterprise Community Partners, Fahe, Grounded Solutions Network, Housing Assistance Council, Housing Partnership Network, Local Initiatives Support Corp., National Council of State Housing Agencies, National Community Stabilization Trust, National Housing Conference, National Housing Trust, NeighborWorks America, Next Step, Novogradac, Opportunity Finance Network, Prosperity Now, RMI, and ROC USA.