As forbearances and other government relief efforts come to an end over the next few weeks and months, many a commercial mortgage borrower will face a reckoning.

Until now, delinquencies in the sector have been a little bit lower than expected, thanks to the Paycheck Protection Program and other funding that

During the month, new delinquencies totaling $8.4 billion outpaced $1.7 billion in resolutions. And that trend is

"The velocity of loan transfers to special servicing remains high, and Fitch expects the volume of specially serviced loans to further spike through the remainder of the summer," Stephanie Duski, associate director CMBS, and Melissa Che, senior director CMBS at Fitch, wrote in a report.

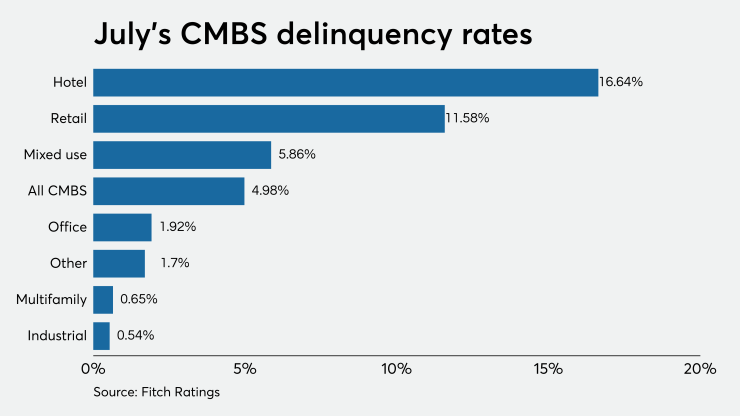

The highest default rates were in the two sectors heavily impacted by COVID-19 restrictions: hotels at 16.64% (up from June's 11.49%) and retail at 11.58% (up from 7.86%). Other property types had smaller increases, but office properties had no change in their delinquency rate. For industrial properties, the rate improved.

Commercial servicers need to prepare for workouts with their borrower. Unlike most residential securitizations, the commercial sector does not have a standardization and as a result, modifications are going to be really on "a case-by-case basis, [depending] on the borrower and the sponsor and the structure and how much capital is really there," said Anne Jablonski, the executive managing director and head of commercial real estate at SitusAMC, which is a master and special servicer.

"What we are really keeping an eye open on is what is going to happen" over the next few months," Jablonski said. "We don't know but we suspect that we will start to see delinquencies increase in those months as that funding runs out."

If additional relief packages come out of Congress, that could change, she added.

Three House members — Van Taylor, R-Texas; Al Lawson, D-Fla.; and Andy Barr, R-Ky. — introduced H.R. 7809, the Helping Open Properties Endeavor (HOPE) Act, at the end of July looking to put a hold on commercial foreclosures. The bill's sponsors said businesses with CMBS debt have a particular challenge since loan covenants are governed by multiparty contracts, which typically prohibit them from taking on additional debt. They also have less flexibility to modify their loans since bondholders expect principal and interest payments to be maintained.

For many commercial borrowers, the

First, the borrower must not have been in default prior to the pandemic's start. Second, the borrower has been cooperatively working with the lender in providing documentation and being transparent about the situation. Finally, the borrower displays a willingness to put additional capital into the deal or otherwise personally guarantee obligations.

“What will borrowers and sponsors be willing to put in by way of additional equity in exchange for getting additional forbearance? It's not just 'we're going to extend the term of this loan,'" Weil said.

Forbearances are "not available for every borrower," added Mark Silverman, the other co-leader of Dykema's CMBS special-servicer group. "It's purely a needs-based analysis; it's not just everybody that asks gets the relief that they're seeking. Some borrowers may have other avenues for paying their debts."

When it comes to hotel properties in CMBS, "lenders are taking a wait and see approach, depending on the creditworthiness of the sponsors, of the hotels, the borrower," said Weil.

Meanwhile, "Retail was in

No matter the property type, "the goal is usually to get a borrower back to performing status; a performing loan is the gold standard of the servicing world," said Weil. After all, the goal of servicers is to achieve the highest possible result and return for the bondholders.

Despite the concerns on the horizon, there’s at least one bright spot in the world of commercial mortgages.

"We're starting to see the [commercial] securitization sector re-open. Investor demand has continued to stay strong and spreads have tightened back in," Jablonski said.

The most attractive deals to lenders have one particular characteristic.

"While there may be liquidity and capital, it is all about the cash flow," Jablonski said. "It is affecting values, some more dramatically than others."

Hotel and retail properties, naturally, are harder to find funding for.

"So the deal structures are getting adapted during COVID, but there is still a lot of uncertainty as to what's going to happen," Jablonski explained. "We know there's going to be ensuing ongoing pain for certain investors.

"While there are signs of recovery, these sectors [retail and hotels] are still going to remain under severe near-term pressure," and it remains unknown at this time what the actual losses from those property types are going to be, she said.