Citigroup's fourth-quarter 2017 residential mortgage banking revenue was 22% lower from the previous year because the company

Mortgage banking revenue was $197 million for the fourth quarter, up 7% from the third quarter's $185 million.

For the full year, the company reported mortgage banking revenue of $751 million.

Its third-party mortgage servicing portfolio was $47.3 billion on Dec. 31, down from $143.2 billion on the same day in 2016, reflecting the $97 billion MSR sale to New Residential.

But it was not just on the servicing side that Citi's mortgage operations got smaller. Loan production was down 46% in the fourth quarter from the same period last year.

Citi originated $3 billion during the quarter, compared with $3.2 billion in the third quarter and $5.6 billion in the fourth quarter of 2016.

For the year, it had total production of $13.1 billion, down from $24 billion for all of 2017.

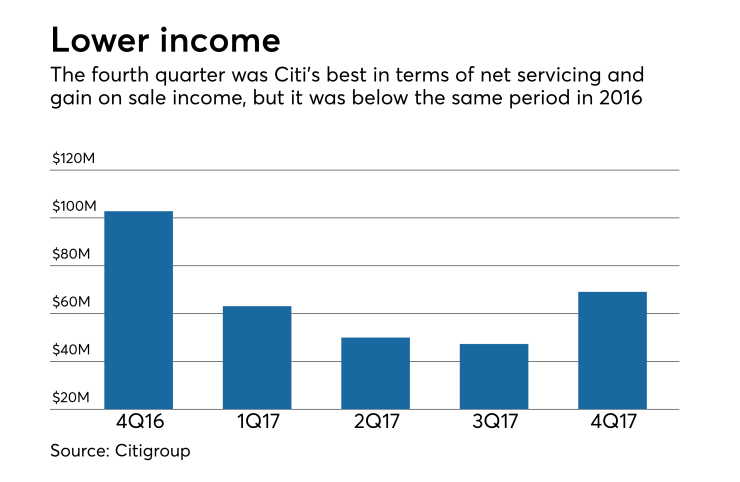

Because of the drop-off in new production and the smaller portfolio, the combined net servicing and gain-on-sale income for the fourth quarter was $69.1 million, down from $102.8 million in the same period in 2016. It was a 46% increase over the third quarter's $47.3 million.

For the full year, the combined net servicing and gain-on-sale income was $229.5 million, down from $433.2 million in 2016.

Citigroup lost $18.3 billion in the fourth quarter because it took a $22 billion noncash charge related to tax reform. Without the charge, Citigroup would have earned $3.7 billion during the quarter.