Consumer home buying power rose 13.7% annually in June and 1.1% from last month, according to First American's Real House Price Index. That compared to a 15.9% annual jump and a 1.3% month-to-month increase

The Real House Price Index — a metric that adjusts residential property prices for income and mortgage rate fluctuations —

"Housing’s strong rebound has been driven by several factors that existed before the coronavirus outbreak but have continued or even gained strength amid the pandemic," Mark Fleming, chief economist at First American, said in the report. "Yet, all real estate is local and affordability dynamics can vary greatly at the market level. While the path of economic recovery remains uncertain, the dynamics in these markets demonstrate how changes in house-buying power influences affordability."

By state, Vermont led the country with a 10.6% increase in RHPI from June 2019. Gains of 10.3% in New Mexico and 9.4% in Montana followed.

RHPI decreased the furthest in Louisiana, down 10.1% annually, trailed by falls of 7.4% in New Hampshire and 7.1% in West Virginia.

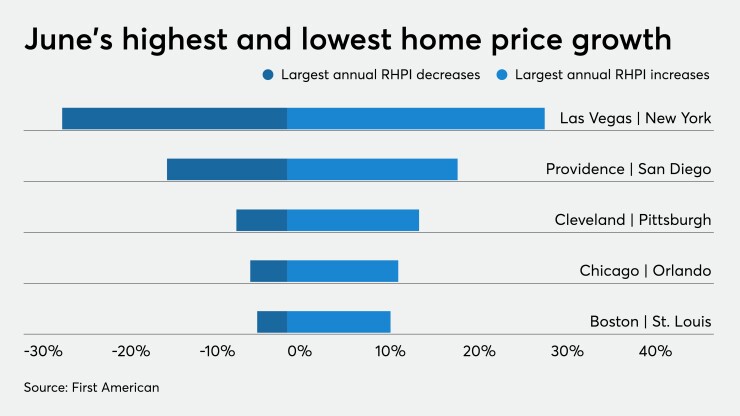

Broken down by metro area, RHPI rose in 35 of the 44 largest markets tracked. New York's 29.3% jump led all increases,

"Faster nominal house price appreciation and lower household income can erode, or even completely eliminate, the affordability boost from today’s record low mortgage rates. From June 2019 until April 2020, affordability was improving for all top markets as house-buying power outpaced house price appreciation," Fleming said. "However, as the pandemic and its impacts linger, house-buying power is no longer winning the affordability tug-of-war against nominal house price appreciation in many markets."