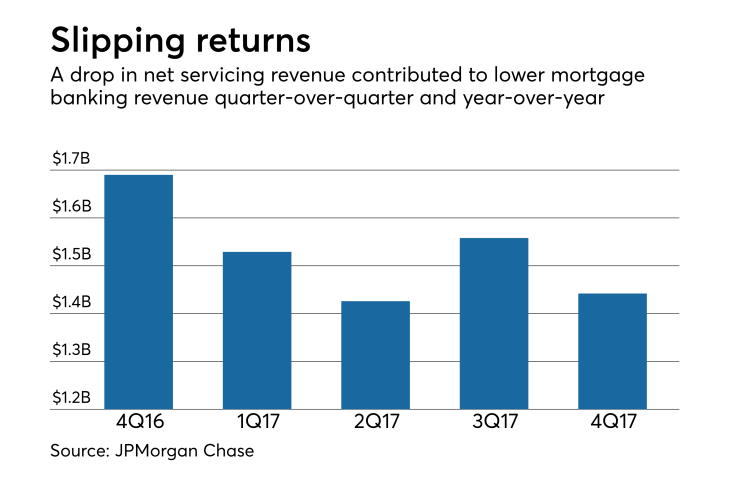

JPMorgan Chase reported lower mortgage banking revenue in the fourth quarter as the returns from its servicing business declined from the previous year.

The company had $1.44 billion of mortgage banking revenue in the fourth quarter, down 15% from $1.69 billion for

Its mortgage banking revenue for the full year was $5.96 billion, down 19% from $7.36 billion in 2016.

On the origination side, volume slipped 9%

Its home lending unit originated $24.4 billion in the fourth quarter, compared with $26.9 billion for the third quarter and $29.1 billion in the fourth quarter of 2016.

For the full year, JPMorgan Chase originated $97.6 billion, a 6% decline from 2016's $103.9 billion.

Retail production made up $11 billion of the fourth-quarter volume while correspondent purchases totaled $13.4 billion. During 2017, it had $40.3 billion of retail production and $57.3 of correspondent originations.

Net production revenue totaled $185 million in the fourth quarter, up 17% from $158 million in third quarter and 1% from $183 million in the fourth quarter of 2016.

JPMorgan Chase's mortgage servicing portfolio totaled $816.1 billion (including $553.5 billion serviced for third parties) as of Dec. 31, 2017, compared with $846.6 billion ($591.5 billion serviced for third parties) on the same day one year prior.

Net servicing revenue declined both on a quarter-to-quarter and year-to-year basis to $193 million from $270 million in the third quarter and $327 million in the fourth quarter 2016.

JPMorgan did release $150 million of reserves related to mortgage lending because of continued improvement in both home prices and delinquencies.