Zillow Group and the Consumer Financial Protection Bureau will attempt to negotiate a settlement to resolve an investigation into whether its co-marketing advertising for real estate and mortgage companies violates the Real Estate Settlement Procedures Act.

The

"We have been invited to discuss a possible settlement and informed that if those discussions do not result in a settlement, the CFPB intends to pursue further action. We believe that our co-marketing program has, and continues to, allow agents and lenders to comply with the law while using our product," she said.

Philips told analysts she was traveling to Washington, D.C., on Aug. 9 for the first settlement meeting with the CFPB, and expects the negotiations to move quickly.

The CFPB declined to comment.

"We continue to believe that our acts and practices are lawful and that our co-marketing program allows lenders and agents to comply with RESPA, and we will vigorously defend against any allegations to the contrary," a Zillow regulatory filing reads. "Should the CFPB commence an action against us, it may seek restitution, disgorgement, civil monetary penalties, injunctive relief or other corrective action."

Zillow has not accrued any reserves related to this matter, the filing adds.

The CFPB has expressed significant concerns about

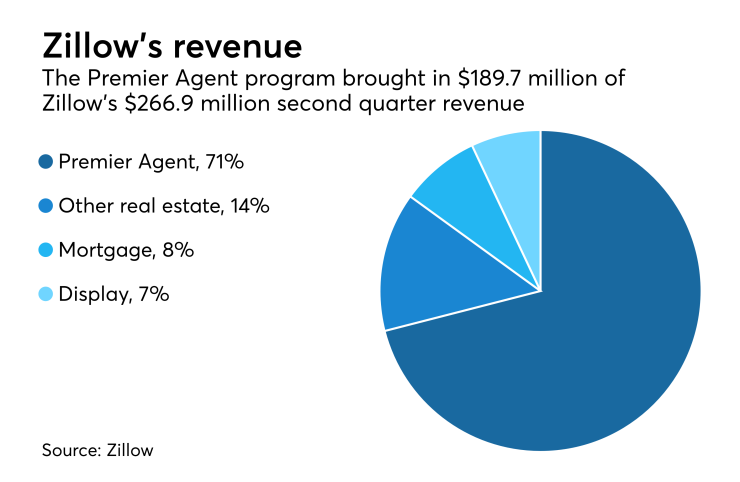

Premier Agent generated $189.7 million in revenue for Zillow during the second quarter, up 29% over the previous year, Philips said.

The program represented 71% of Zillow's total second quarter revenue of $266.9 million.

With the co-marketing program, a Zillow premier agent can invite a lender to share up to 50% of the online marketing costs. The agent can invite up to five lenders.

It is legal to split marketing costs as long as the space or frequency for the lender's advertising is commensurate with the payment.

In January, the CFPB

The brokers, Keller Williams Realty Mid-Willamette and Remax Gold Coast, were also fined.