The Consumer Financial Protection Bureau is assembling a new enforcement team and hiring more personnel as it prepares to toughen oversight of banks, mortgage servicers and other financial firms.

President Biden’s pick to lead the agency, Federal Trade Commissioner Rohit Chopra, has not yet had a nomination hearing before the Senate Banking Committee. But the agency under acting Director Dave Uejio has already named a new head of enforcement and launched an effort to recruit attorneys.

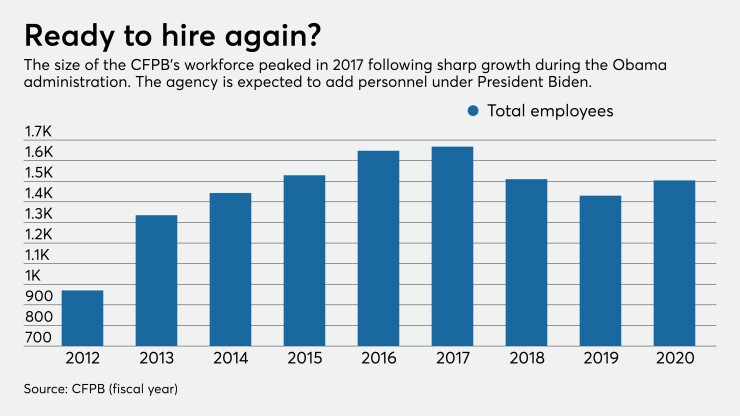

The size of the agency's workforce tapered off during the Trump administration as enforcement activity slowed. But observers see the latest personnel moves as a sign that the bureau aims to bulk up under new leadership, even before Chopra is confirmed.

“They are ramping up for an increase in the number of enforcement investigations and activity,” said Tony Alexis, a partner at Goodwin Procter and a former CFPB assistant director and head of enforcement. “Headcount is an incredible part of the resources that need boosting.”

Uejio has already installed Cara Petersen as acting head of enforcement, succeeding former Director Kathy Kraninger's enforcement chief, and appointed new senior officials to oversee Trump appointees. He also announced plans on LinkedIn and an agency blog to recruit additional attorneys for multiple areas.

"We must hold accountable companies that break the law and harm American consumers and small businesses during this time of incredible financial stress," he said in the Feb. 9 blog. "To do this, we need the fullest talents and passion of the American public. The Bureau has one of the most remarkable workforces I have ever seen, and I invite you to seize the moment and join us."

The hiring moves come as Uejio also has

“It’s clear that they intend to become really aggressive as quickly as they can,” said Scott Pearson, a partner at Manatt, Phelps & Phillips.

To be fair, CFPB enforcement actions picked up toward the end of the Trump era. Tom Ward, Kraninger's enforcement director, filed 52 such orders last year, the highest number since 2015.

But in a move appearing to clear the way for Chopra to put his own managers in top positions, Ward was moved out of the job recently and into a new role to make way for Petersen, according to internal agency emails. Petersen has been with the bureau since 2011. Ward will serve as executive senior counsel in the division of Supervision, Enforcement and Fair Lending.

The change in enforcement chiefs is just the beginning of a return to reviving the approach taken by former CFPB Director Richard Cordray during the Obama administration, experts said.

"There may be a lot of reshuffling within the bureau," said Courtney Dankworth, a litigation partner at Debevoise & Plimpton. "Cordray was obviously quite aggressive and set the stage as the first director for what the bureau could do, so [Chopra] doesn’t have to break new ground."

The national campaign to recruit attorneys follows a 17% drop in staffing at the agency during the Trump administration.

Still, some experts were surprised at the scope of the recruitment drive. In addition to the LinkedIn page, the agency also is actively recruiting from the Hispanic Bar Association, the National Asian Pacific American Bar Association, law schools, government entities and nonprofits, according to a CFPB spokesperson. The bureau has also engaged with current and former members of its advisory committees about the hiring efforts, the spokesperson said.

"They are trying to staff up aggressively and trying to get the word out through nontraditional means, which suggests they have big plans for what they want to do," said Lucy Morris, a partner at Hudson Cook and former CFPB deputy enforcement director.

In his

The "CFPB was created for moments like this,” Uejio wrote. "Born out of the Great Recession, the CFPB was forged in crisis to vigorously protect America’s consumers. Achieving this goal requires vigorous oversight of all applicable Federal laws and the fullest utilization of our legal authorities.”

The ramp-up in hiring follows a three-year period of mostly attrition under the Trump administration. When former acting CFPB Director Mick Mulvaney took control of the agency in late 2017, he immediately instituted a two-year hiring freeze. Though Kraninger vowed to increase hiring in 2019, the bureau's headcount dropped 17% under her watch to a low of 1,421 in June 2020, from a peak of 1,712 in June 2017 under Cordray. The CFPB had 1,504 employees at the end of December, according to the bureau’s financial statements.

"It makes a lot of sense that they want new attorneys and to beef up the overall numbers because they have had attrition of employees over the last few years that haven’t been replaced," said Dankworth.

Meanwhile, though Mulvaney’s

Uejio has already signaled that the bureau will be scrutinizing how consumers have been treated by auto lenders, banks, debt collectors and mortgage servicers under the Coronavirus Aid, Relief, and Economic Security Act. Many expect an increase in the number of enforcement actions and the size of penalties and fines.

"I expect to see more big names in their sights where they go after players affecting millions of consumers with very large penalties," said Dankworth.